The US Yield Curve Could Invert in Late 2018

When could the yield curve invert? St. Louis Fed president and CEO James Bullard gave a presentation at a regional economic briefing on December 1. In his presentation, Bullard laid out some conditions that could lead to yield curve inversion in 2018. As discussed previously in this series, an inverted yield curve is considered a sign of […]

Dec. 11 2017, Updated 10:32 a.m. ET

When could the yield curve invert?

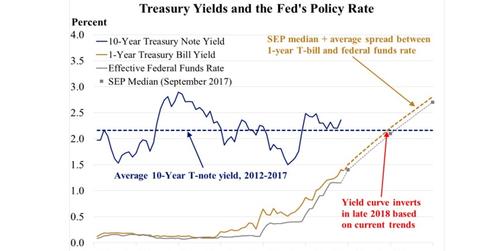

St. Louis Fed president and CEO James Bullard gave a presentation at a regional economic briefing on December 1. In his presentation, Bullard laid out some conditions that could lead to yield curve inversion in 2018. As discussed previously in this series, an inverted yield curve is considered a sign of future recession. The conditions adescribed by Bullard are as follows:

- long-term yields (TLT) remain near their average since 2012

- the Fed continues to increase tpolicy rates as suggested in its summary of economic projections

What are the consequences of yield curve inversion?

Bullard stated that the slope of the yield curve is considered a good predictor of future economic activity. This statement has been proven empirically, in that previous recessions have always been preceded by an inverted yield curve.

We need to remember that an inverted yield curve is only a possible sign of future recessions, and there is no guarantee that history repeats itself. Another important point to consider is that anything could happen between now and late 2018. Inflation (TIP) could improve, or new tax policies, once implemented, could boost economic activity.

Caveats of the inverted yield curve prognosis

In his presentation, Bullard indicated that the empirical proposition of an inverted yield curve signaling recession makes sense as long as long-term interest rates (RINF) remain low. He said that there could be other factors driving long-term (LTPZ) interest rates lower that have not been identified so far. However, he said that, based on historical evidence, it would be prudent for policymakers and bond (BND) market participants to remain cautious about the possibility of yield curve inversion. In the next part of this series, we’ll look at what Bullard suggests to avoid yield curve inversion.