What Analysts Recommend for Tyson Foods

Of the 18 analysts covering Tyson Foods, 67.0% recommend a “buy” on its stock.

April 3 2018, Updated 9:50 a.m. ET

The majority of analysts maintain a “buy”

Most analysts maintain a “buy” rating on Tyson Foods (TSN) stock thanks to the strong demand for protein-rich foods in the domestic and export markets. Analysts expect strength in the beef and chicken segment is likely to drive its top and bottom lines higher. The availability of cattle supply, expectations that demand will outpace the increase in livestock supply, and lower feed costs are expected to support Tyson Foods’ sales and earnings growth rate in 2018.

The company is restructuring its product portfolio by divesting non-core non-protein businesses to better align with the changing needs of consumers. Besides, lower tax rates are further expected to cushion its earnings growth. Tyson Foods projects 23% to 26% growth in its adjusted earnings in fiscal 2018 driven by strong sales and lower taxes.

However, China’s recent increase in tariffs on pork products could act as a deterrent and negatively impact the sales and earnings of meat producers like Tyson Foods, Sanderson Farms (SAFM), Hormel Foods (HRL), and Pilgrim’s Pride (PPC).

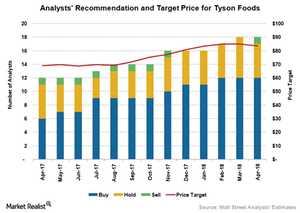

Analysts’ ratings and price target

Of the 18 analysts covering Tyson Foods, 67.0% recommend a “buy” on its stock. Meanwhile, 28.0% maintain a “hold,” and 5.0% suggest a “sell.” Analysts maintain a price target of $85.53 per share on Tyson Foods stock, which implies an upside potential of 24.6% to its closing price of $68.64 on April 2, 2018.

Following the hike in tariffs, analyst Timothy Ramey at Pivotal Research downgraded TSN stock to “sell” from “hold” and reduced the target price from $75 to $55 per share.