The Tax Reform Bill’s Impact on Precious Metals

All four precious metals saw a down day on Monday, December 4, 2017, after the US dollar, in which the four metals are priced, rose $0.39%, propelled by the Senate passing its tax reform bill.

Dec. 5 2017, Published 2:27 p.m. ET

Tax reform and precious metals

All four precious metals saw a down day on Monday, December 4, 2017. The US dollar, in which the four metals are priced, rose that same day. The U.S. Dollar Index (or DXY), which prices the dollar against a basket of six major world currencies, increased 0.39% on Monday.

The US dollar was propelled after the Senate passed its tax reform bill early Saturday morning, December 2, 2017. That brings President Donald Trump one step closer to his goal of reducing the corporate tax rate. Lowering the tax rate could give the US economy a boost, which could be positive for the dollar. Tax reform could also cause the Fed to be more aggressiveness with interest rate hikes.

However, a lower corporate tax rate could be negative for precious metals since they’re famous as safety assets that perform well when the economy is underperforming.

Dollar impact

There could also be a dual downward pressure for gold and for funds such as the ETFS Physical Swiss Gold (SGOL) and the iShares Gold Trust (IAU), which fell 0.32% and 0.24%, respectively, on Monday, December 4, 2017.

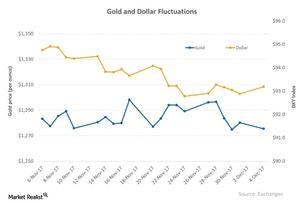

The above chart shows the changes in precious metals compared to the changes in the US dollar. The dollar and precious metals are often known to deviate from each other, resulting in an inverse relationship.

Mining companies that fell on Monday due to the fall in precious metals include Kinross Gold (KGC), Alacer Gold (ASR), Coeur Mining (CDE), and Pan American Silver (PAAS). They fell 3.1%, 3.4%, 5.6%, and 2.1%, respectively. Combined, these four miners contribute ~6% to the price changes in the VanEck Vectors Gold Miners ETF (GDX).