China’s Steel Demand Indicator Slowdown—How Will Iron Ore React?

China’s property sector is one of the most steel-intensive sectors, consuming approximately 50% of overall steel in the country.

Dec. 15 2017, Updated 7:30 a.m. ET

China’s property sector

China’s property sector is one of the most steel-intensive sectors, consuming approximately 50% of overall steel in the country. It’s therefore imperative for investors to track the property sector through its indicators, which we’ll discuss later in this article.

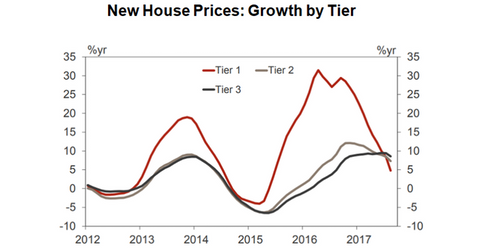

While the rally in Chinese steel prices was due to the firmer property market, the market now seems to be cooling down. This cooldown is most likely due to tighter liquidity conditions in the market. New construction starts and property starts fell in October 2017. In October, real estate investment growth also fell to just 5.6% from 9.2% year-over-year (or YoY) growth in September 2017.

China’s auto sales

China’s total vehicle sales rose 2.0% in October 2017 month-over-month. Sales in the first ten months of 2017 have risen 4.1% from the same period last year.

After October’s data was released, the China Association of Automobile Manufacturers warned that the growth target of 5.0% for 2017 probably wouldn’t be met. It added that the growth wouldn’t exceed ~4.0%, based on the year-to-date data.

Lackluster growth in the property and auto markets may not bode well for the steel demand in the country.

Lower steel demand (SLX) is negative for iron ore demand. The miners, which constitute the majority of the seaborne-traded iron ore include Rio Tinto (RIO), Vale (VALE), BHP (BHP), and Fortescue Metals Group (FSUGY). Cleveland-Cliffs (CLF) contribute to a very small portion to the overall seaborne iron ore trade, still, its stock is impacted by the changes in the iron ore prices.