What Oil Bulls Could Expect for Oil Inventories

Oil stockpiles In the week ended December 8, 2017, US crude oil inventories fell by 5.1 MMbbls (million barrels) to 443 MMbbls. However, motor gasoline inventories rose 5.7 MMbbls. The data was released by the EIA (U.S. Energy Information Administration) on December 13. That day, US crude oil prices fell 0.9%. Inventory spread The gap between US oil inventories […]

Dec. 19 2017, Updated 4:00 p.m. ET

Oil stockpiles

In the week ended December 8, 2017, US crude oil inventories fell by 5.1 MMbbls (million barrels) to 443 MMbbls. However, motor gasoline inventories rose 5.7 MMbbls. The data was released by the EIA (U.S. Energy Information Administration) on December 13. That day, US crude oil prices fell 0.9%.

Inventory spread

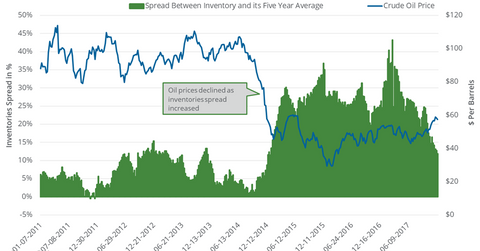

The gap between US oil inventories and their five-year average could impact oil prices. The inventory spread has an inverse relationship with oil (UCO) (BNO) prices. An expansion in the inventory spread may impact oil prices, and vice versa.

In the week ended December 8, the inventory spread was at 11.9%, 80 basis points narrower than in the previous week. After December 13, the day the EIA released oil inventory data, US crude oil (OIIL) (USL) (DBO) futures rose 1.1%.

Where should inventories be for bulls to gain?

In the week ended December 15, 2017, US crude oil inventories would need to fall below ~441.08 MMbbls or more than~1.9 MMbbls for the inventory spread to further contract. The EIA will report US crude oil inventory data for that week on December 20, 2017.