Why Japan Services PMI Didn’t Meet Expectations in November

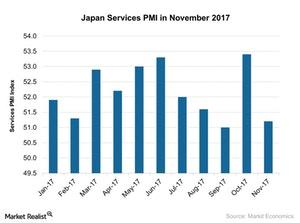

The Japan Services PMI fell in November 2017. It came in at 51.2 compared to 53.4 in October. It didn’t meet the market expectation of 52.0.

Dec. 13 2017, Published 9:12 a.m. ET

Japan Services PMI in November

According to Markit Economics, the Japan Services PMI (Purchasing Managers’ Index) (EWJ) (DXJ) fell in November 2017. It came in at 51.2 compared to 53.4 in October. It didn’t meet the market expectation of 52.0.

It was the 14th consecutive month of expansion in service activity. A level above 50 is considered expansion, while a level below 50 is considered contraction. November’s services PMI showed weaker expansion than the strong expansion seen in October.

Weaker improvement in the services PMI for November was mainly due to no improvement in new orders and a slowdown in export orders. Production output also rose at a slower rate, and employment growth remained stagnant. Overseas (VT) (ACWI) (VTI) demand in the services sector fell in November.

Performance of ETFs

The iShares MSCI Japan ETF (EWJ), which tracks the performance of Japan, rose 2.1% in November 2017. The WisdomTree Japan Hedged Equity ETF (DXJ) rose 0.9% in November 2017.

The improved performances of major Japan-tracking ETFs in November 2017 seem to indicate that investors are optimistic about Japan’s economic activity and business condition.

In the next part of this series, we’ll analyze the indicators that investors should watch this week.