How GWR’s North American Carloads Trended in February

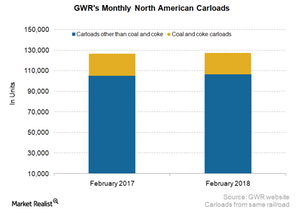

In February 2018, Genesee & Wyoming’s (GWR) North American carloads expanded 0.3% YoY (year-over-year) on a reported basis.

March 15 2018, Updated 12:35 p.m. ET

GWR’s North American carloads

In February 2018, Genesee & Wyoming’s (GWR) North American carloads expanded 0.3% YoY (year-over-year) on a reported basis. Newly acquired railroads added 437 carloads to the North American carloads in February. GWR’s same-railroad operations saw over 127,300 carloads, up 0.7% compared with a little less than 126,500 carloads in February 2017. The company’s same railroad operations have registered volume gains in North America for the past several months.

Coal shipments in February

The coal (ARLP) and coke commodity group have been a weak spot for Genesee & Wyoming’s North American freight volumes for the past few months. February 2018 wasn’t an exception. In that month, GWR’s coal and coke carloads fell 2.1% to slightly higher than 20,800 units in February 2018 from less than 21,300 units in the corresponding month last year. Coal’s share in overall carloads fell marginally to 16.4% from 16.8% in February 2017. Although coal and coke’s share dropped in February 2018 on a year-over-year basis, the share of other-than-coal and coke carloads rose slightly.

Ups and downs in carload commodity groups

GWR witnessed increased volumes of these carload commodity groups in February:

- food and kindred products

- lumber and forest products

- metallic ores

- minerals and stones

- pulp and paper

These carload commodity groups recorded lower volumes in the month:

- agricultural products

- auto and auto parts

- chemicals and plastics

- metals

The railroad’s agricultural product shipments declined 8.3% in February 2018 due to reduced grain shipments in GWR’s Midwest and Central regions.

ETF discussion

Transportation stocks’ (JBHT) ratings have been upgraded by key research firms recently. Lower tax rates and momentum in US industrial production should drive them further in the coming quarters. If you are bullish about transportation and logistics stocks, then consider the iShares US Industrials ETF (IYJ). Prominent railroad (UNP) companies in the US account for 6% of IYJ’s portfolio holdings.

In the coming part, we’ll analyze Genesee & Wyoming’s United Kingdom and European freight volumes.