Where DMLP’s Earnings Margin Stands among Top MLPs

Dorchester Minerals, a mineral interest MLP (master limited partnership), has the third-best EBITDA margin among MLPs today.

Dec. 7 2017, Updated 3:30 p.m. ET

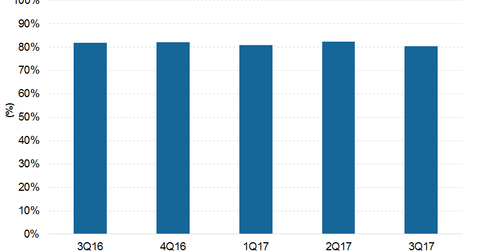

TTM EBITDA margin

Dorchester Minerals (DMLP), a mineral interest MLP (master limited partnership), has the third-best EBITDA (earnings before interest, tax, depreciation, and amortization) margin among all MLPs today.

DMLP posted a TTM (trailing-12-month) EBITDA margin of 81.3% in 3Q17. Similar to Viper Energy Partners (VNOM), DMLP benefits from no drilling and production expenses, which have driven its EBITDA margin higher.

Dorchester Minerals’ strong EBITDA margins have driven its net income margins, resulting in strong distribution growth. DMLP reported a net income margin of 57.8% in the third quarter of 2017. At the same time, it posted a YoY distribution growth of 12.9%.

Analyst recommendations

As of December 5, Dorchester Minerals has no coverage from Wall Street analysts, likely because the partnership is so small. The partnership reported revenues of $12.5 million in the third quarter of 2017.

In the next part of this series, we’ll look into the EBITDA margin for EQT Midstream Partners (EQM).