Sanofi’s Generics and Consumer Healthcare Business in 1Q17

Sanofi’s (SNY) Generics business contributes ~5% to the group’s total revenues.

May 29 2017, Updated 10:36 a.m. ET

Generics business

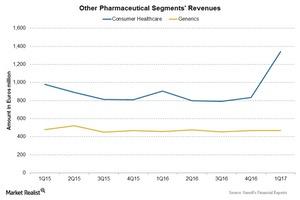

Sanofi’s (SNY) Generics business contributes ~5% to the group’s total revenues. The Generics business reported revenues of 468 million euros in 1Q17, representing growth of 2% over its 1Q16 revenues.

Considering the constant exchange rates, its revenues fell 2% during 1Q17. Its revenues declined due to lower sales in the US and European markets, substantially offset by growth in the rest of the world.

Consumer Healthcare business

Sanofi’s Consumer Healthcare business includes various products that treat allergies, coughs, colds, pain, and digestive issues. It also includes nutritional categories. The Consumer Healthcare business reported revenue growth of 42.7% at constant exchange rates to ~1.3 billion euros in 1Q17.

The growth of Consumer Healthcare revenues was driven by 58.7% growth at constant exchange rates in revenues from allergy, cough, and cold products such as Allegra and Nasacort. Allergy, cough, and cold products reported revenues of 414 million euros in 1Q17.

The revenues from pain products such as Doliprane reported 45.1% growth in revenues at constant exchange rates. Pain products reported revenues of 324 million euros in 1Q17.

The revenues from digestive products rose 55.6% at constant exchange rates to 229 million euros in 1Q17, while revenues from nutritional products rose 36.3% at constant exchange rates to 164 million euros in 1Q17.

For broad-based industry exposure, investors can consider the First Trust Value Line Dividend ETF (FVD), which holds 0.6% of its total assets in Sanofi. The First Trust Value Line Dividend ETF holds 0.6% of its total assets in Novo Nordisk (NVO), 0.6% of its total assets in Novartis (NVS), and 0.5% of its total assets in GlaxoSmithKline (GSK).