Which Fast Food Restaurant Led in 4Q15 Revenue Per Square Foot?

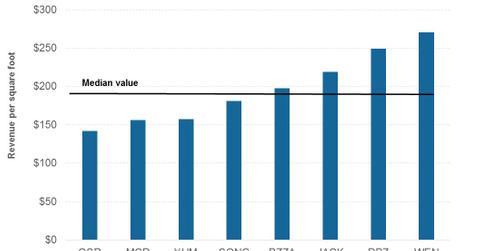

In 4Q15, MCD, YUM, WEN, QSR, JACK, SONC, PZZA, and DPZ generated an average revenue of $189 per square foot.

March 9 2016, Updated 8:07 a.m. ET

Average revenue per square foot

A company’s average revenue per square foot gives information about how efficiently it’s been utilizing its resources. In 4Q15, the eight fast food restaurant companies under review in this series generated an average revenue of $189 per square foot.

The above chart depicts the average revenue per square foot generated by each company. Revenue per square foot is calculated by dividing revenue from company-operated restaurants with company-operated restaurants’ total square feet during 4Q15.

The leaders

With revenue per square foot of $270.3 in 4Q15, Wendy’s Company (WEN) beat the other seven companies under review with better utilization of its restaurant space. WEN was followed by Domino’s Pizza (DPZ), Jack in the Box (JACK), and Papa John’s (PZZA), which recorded revenue per square foot of $249.4, $219.3, and $197.4, respectively. These amounts were above the median of $189.

The laggards

Burger King, operating under the umbrella of Restaurant Brands International (QSR), generated the lowest revenue per square foot at $142.3. McDonald’s (MCD), YUM! Brands (YUM), and Sonic (SONC) also recorded lower revenue per square foot than the median at $156.3, $157.2, and $181.3, respectively.

Having discussed revenue drivers and the efficiency of these companies in utilizing their resources, let’s move on to EBIT (earnings before interest and tax) margins in our next article.

You can gain exposure to restaurant companies by investing in the iShares Russell 2000 Growth ETF (IWO), which invests 0.22% in Papa John’s.