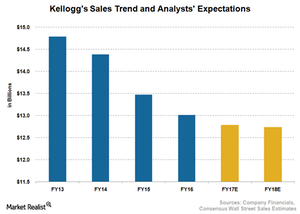

Why Analysts Expect Kellogg’s Sales to Fall

Kellogg (K) estimates a 3% decline in its top line for fiscal 2017, reflecting weakness in the cereal category and challenges in several markets.

Dec. 15 2017, Updated 7:32 a.m. ET

What’s affecting Kellogg’s top line?

Kellogg’s (K) sales witnessed sequential improvement during 3Q17, thanks to favorable currency rates. The company’s top line also received a boost from its Parati acquisition in Brazil. However, weakness in the consumption of cereals, primarily in the United States (SPY), is pressuring its growth.

Kellogg’s cereal category experienced low demand in the health and wellness brands for adults in the US, which is affecting its sales. Price adjustments resulting from the shift from direct-store-delivery (or DSD) to warehouse delivery could result in lower sales in the near term.

Kellogg’s North American business remains challenged, reflecting lower volumes resulting from the demand shift toward wellness foods.

Among the other packaged food manufacturing companies, General Mills (GIS), J.M. Smucker (SJM), and Kraft Heinz (KHC) are also witnessing soft volumes in the US, reflecting weak demand.

What to expect

Kellogg (K) estimates a 3% decline in its top line for fiscal 2017, reflecting weakness in the cereal category and challenges in several markets. A tough retail environment and price adjustments could further affect its sales growth.

Hurricane-related shipments positively impacted Kellogg’s 3Q17 sales. However, 4Q17 should bring the company’s sales to a normal trend and could result in a sequential decline in sales.

Pringles sales improved in Europe and are generating higher sales across several other markets, which could supplement the company’s top-line growth. Strength across the U.S. Frozen Foods category, brand-building investments, and incremental sales from the Parati acquisition could drive its top-line growth rate. Currency risk is expected to subside, which is a positive factor.

Analysts project a 1.8% decrease in Kellogg’s top line for 2017. Its 2018 sales are expected to mark a marginal decline, as can be seen in the chart above.