Aluminum Supply: What Investors Should Watch in 2018

After its split, Alcoa (AA) became a pure-play aluminum producer (S32) (CENX). Like other aluminum producers, Alcoa’s fortunes are tied to metal prices.

Dec. 21 2017, Updated 12:15 p.m. ET

Aluminum supply

After its split, Alcoa (AA) became a pure-play aluminum producer (S32) (CENX). Like other aluminum producers, Alcoa’s fortunes are tied to metal prices (DBC) (AWC). Aluminum prices were strong this year and built on their 2016 gains. Aluminum was among the best-performing base metals in 1H17. The lightweight metal outperformed copper in 1H17 by a decent margin. However, aluminum came under selling pressure in November. In this part, we’ll see which factors could drive aluminum prices in 2018.

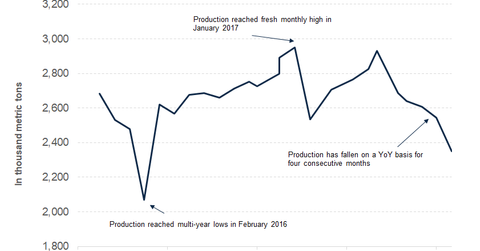

Chinese curtailments

We saw some moderation in Chinese aluminum production in November. China cut its polluting industrial capacity to address the smog issue during the winter months. The cuts are expected to last until the middle of March. Over the next few months, it would be interesting to watch China’s aluminum production data. Along with the production figures, investors should follow China’s aluminum exports. Despite lower production in November, the country’s aluminum exports rose.

Since aluminum prices have stabilized at higher price levels, we could see some restarts in 2018. Earlier this year, Alcoa announced a partial restart of its Warrick smelter. Along with restarts, we could see Chinese aluminum producers setting up capacity outside China to evade the country’s cuts in the winter. Like we saw this year, Chinese aluminum producers could run their plants at higher run rates in the summer months in anticipation of curtailments during the winter months.

Along with supply, demand-side metrics could also impact aluminum prices in 2018.