Analyst Ratings for Delta Air Lines after Traffic Release

Only one analyst has upgraded Delta Air Lines (DAL) since it released its traffic data on Friday, June 2, 2017.

June 6 2017, Updated 10:36 a.m. ET

Analyst upgrade

Only one analyst has upgraded Delta Air Lines (DAL) since it released its traffic data on Friday, June 2, 2017. Bernstein upgraded the stock to “outperform” from “market perform.”

There have been other analyst upgrades in the past few months. Morgan Stanley raised the airline’s target price to $59 and gave it an “overweight” rating. Citigroup raised the target price to $65 from $63 and gave it a “buy” rating.

There was also negative news for Delta investors. Berkshire Hathaway, which recently bought stakes in Delta, American Airlines (AAL), and Southwest Airlines (LUV), reduced its stake in Delta Air Lines 8.3% to 55.0 million shares. It increased its stake in Southwest Airlines 8.2% to 49.3 million shares and in American Airlines 10.3% to 47.7 million shares. Billionaire investor George Soros also sold his complete stake in Delta Air Lines.

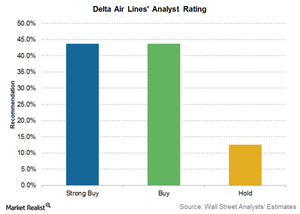

Analyst ratings

Currently, seven (43.8%) of the analysts tracking Delta Air Lines stock have given the airline a “strong buy” rating. Another seven (43.8%) have given it a “buy” rating, and two (12.5%) have given it a “hold” rating. None of the analysts gave it a “sell” rating.

Target price

The 12-month consensus target price for Delta Air Lines is $63.36, which is higher than the $60.50 target price after the company’s March 2017 quarterly results. The highest target price is $75, and the lowest is $52. At the current target price, the stock has a return potential of 23.8%.

Be sure to watch for our traffic updates for other airlines, including United Continental Holdings (UAL), JetBlue Airways (JBLU), and Spirit Airlines (SAVE).

You can gain exposure to Delta Air Lines by investing in the PowerShares Dynamic Leisure & Entertainment ETF (PEJ), which invests 5.1% of its holdings in DAL.