Will Rise in Crude Oil Benefit US Truckload Carriers in 2018?

The average US on-highway diesel prices in 3Q17 have risen 20% compared to the same quarter last year.

Dec. 4 2020, Updated 10:53 a.m. ET

Fuel surcharge revenues

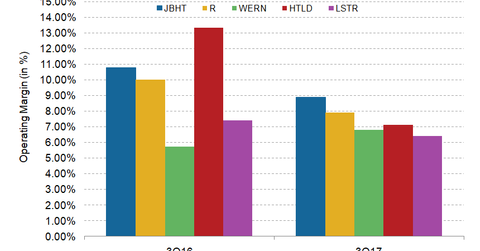

In the previous part of this series, we reviewed the 3Q17 employee costs of the US truckload carriers we’re covering in this series: JB Hunt Transport Services (JBHT), Landstar System (LSTR), Werner Enterprises (WERN), Ryder System (R), and Heartland Express (HTLD). Now let’s look at the share of fuel expenses in their operating costs for the quarter. Let’s also look at the impact of the changes in fuel costs on fuel surcharge revenues for these carriers.

Normally, US truckload carriers (XTN) enter into contracts with their customers based on the escalation of fuel costs. These carriers charge an incremental fuel surcharge if fuel costs go beyond a threshold limit expressed in diesel rate per gallon.

When fuel prices are lower, truckload carriers with long-haul route operations (JBHT) (MRTN) tend to benefit more than operators with short-haul routes. Shippers also prefer long-haul trucking companies over railroads (UNP) if deliveries are time-sensitive. The fuel expenses of a truckload carrier are also impacted by the percentage of alternate vehicles (UPS) in the fleet. It also depends on the fleet age and implementation of fuel-efficient solutions.

Carriers with the highest fuel costs

The average US on-highway diesel prices in 3Q17 have risen 20% compared to the same quarter last year. That, in turn, has jacked up fuel expenses for US truckload carriers. Based on the metric of fuel costs as a percentage of operating expenses, Heartland Express (HTLD) tops the companies we’re covering in this series. Its fuel costs as a percentage of operating expenses were the highest at 16.8% in 3Q17. On a YoY (year-over-year) basis, its fuel costs have fallen 0.7% for the quarter. That reflects fuel efficiency gains for the company.

Werner Enterprises (WERN) is next in line after Heartland. WERN’s fuel expenses accounted for 10.2% of its 3Q17 operating costs. Unlike HTLD, Werner’s fuel expenses as a percentage of operating costs rose 1.7% from 8.5% in the corresponding quarter last year. In spite of its North American operations and huge scale of operations, JB Hunt Transport’s (JBHT) fuel expenses were 5.2% of its operating costs in 3Q17, a slight rise of 0.3%. Ryder System’s (R) fuel costs were 7.2% of its operating expenses in the third quarter, a marginal fall of 7.5% from 3Q16.

We haven’t included Landstar System (LSTR) in the above graph since the company provides asset-light integrated logistics solutions. It purchases trucking services from third parties that actually do the freight hauling. Purchased transportation expenses account for more than 75% of its operating costs.

In the next part, we’ll look at the 3Q17 adjusted earnings of these truckload carriers.