How Halliburton Has Reacted to Crude Oil Prices

Between April 16 and April 23, Halliburton (HAL) stock’s price correlation with crude oil was 0.99, showing that Halliburton and crude oil prices have been strongly correlated in the past week.

Nov. 20 2020, Updated 4:10 p.m. ET

Correlation between Halliburton and crude oil

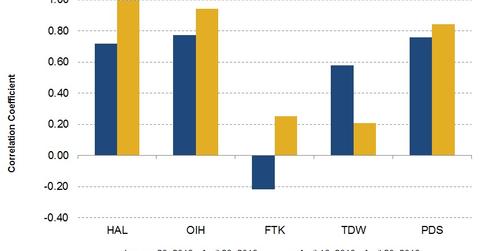

Between April 16 and April 23, Halliburton (HAL) stock’s price correlation with crude oil was 0.99, showing that Halliburton and crude oil prices have been strongly correlated in the past week. Meanwhile, Halliburton’s correlation with the VanEck Vectors Oil Services ETF (OIH), which comprises 25 oilfield equipment and service stocks, was 0.95.

Check out all the data we have added to our quote pages. Now you can get a valuation snapshot, earnings and revenue estimates, and historical data as well as dividend info. Take a look!

What does HAL’s correlation with crude oil mean?

Having a strong correlation with crude oil may be advantageous for HAL stock if crude oil prices rise. On April 20, Halliburton’s correlation with crude oil had been higher in the last week than in the past three months.

Correlation between HAL’s peers and crude oil

Between April 16 and April 23, the VanEck Vectors Oil Services ETF’s (OIH) correlation with crude oil was 0.94, higher than it was in the three months prior. Oilfield service companies’ correlation was as follows:

- Flotek Industries’ (FTK) was 0.25, higher than its correlation in the past three months.

- Tidewater’s (TDW) was 0.21, a steep decrease from its correlation over the past three months.

- Precision Drilling’s (PDS) was 0.84, higher than its correlation over the past three months.

Next, we’ll discuss Wall Street analysts’ targets for Halliburton.