An Update on the Precious Metals as November Comes to an End

The US stock markets were closed on Thursday, November 23, 2017, for Thanksgiving, and the next day (Black Friday) was quite slow for precious metals. Gold played in a narrow range that day.

Nov. 29 2017, Published 10:27 a.m. ET

Reaction of precious metals

The US stock markets were closed on Thursday, November 23, 2017, for Thanksgiving, and the next day (Black Friday) was quite slow for precious metals. Gold played in a narrow range on Friday, November 24, 2017, closing 0.38% lower. Gold futures for December expiration touched the day’s high of $1,293.30 per ounce and a low of $1,285.10, closing at $1,287.3. Silver and palladium tumbled marginally on Friday. Silver fell 0.72% for the day, and palladium fell 0.82%. Platinum, however, rose 0.49% for the day.

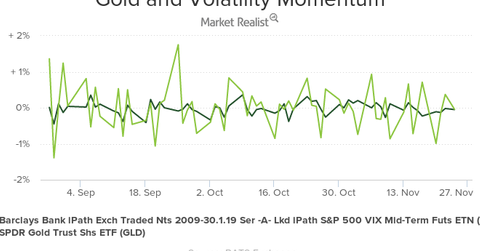

The investor appetite for gold seems to be lower as unrest in the market has slowed down. The market is back from the holiday, and volatility seems to be lower. Gold is often known to closely react to market volatility.

[marketrealist-chart id=2466061]

The above chart compares the volatility reading for gold and the Volatility Index (or VIX) (VXZ) (VIXY).

Global tensions

Since gold is well known as a safety asset, investors often jump to this beloved metal during market instability such as the rising tensions between North Korea and the United States. Previously, geographical tensions added to market volatility and precious metals such as gold and silver (GLD) (SLV).

Lately, much of the price reaction in precious metals and their mining shares is dependent on the movement in the US dollar and the Fed’s decision to move the interest rate higher or not. In the next part of this series, we’ll take a closer look at these relationships.

Among the mining shares that witnessed an up day on Friday, November 24, 2017, despite the loss in precious metals, were Sibanye Gold (SBGL), AuRico Gold (AUQ), Alacer Gold (ASR), and Coeur Mining (CDE).