How Roche’s Oncology Drug Gazyva Is Positioned after 3Q17

In 3Q17, Roche’s (RHHBY) Gazyva generated revenues of 69 million Swiss francs, which reflected ~34% growth on a year-over-year (or YoY) basis.

Nov. 8 2017, Updated 9:01 a.m. ET

Gazyva/Gazyvaro: Revenue trends

In 3Q17, Roche’s (RHHBY) Gazyva generated revenues of 69 million Swiss francs, which reflected ~34% growth on a year-over-year (or YoY) basis. In 3Q17, in the US and European markets, Gazyva generated revenues of 41 million Swiss francs and 19 million Swiss francs, respectively, which reflected ~41% and ~25% growth, respectively, YoY.

From January through September 2017, Gazyva/Gazyvaro generated revenues of 202 million Swiss francs, which reflected ~40% growth YoY.

About Gazyva

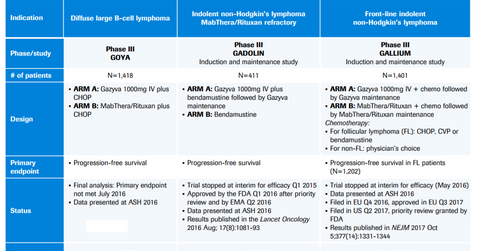

Gazyva (obinutuzumab) is indicated in combination with chlorambucil for the treatment of individuals with prior untreated chronic lymphocytic leukemia (or CLL). Gazyva is used in combination with bendamustine followed by Gazyva monotherapy for the treatment of individuals with follicular lymphoma whose disease relapsed post-therapy with the rituximab-containing regimen.

In September 2017, the European Commission (or EC) approved Gazyvaro (obinutuzumab) in combination with chemotherapy, followed by Gazyvaro maintenance therapy for the treatment of individuals with prior untreated advanced follicular lymphoma.

The EC approval of Gazyvaro is based on the results from the Phase 3 GALLIUM trial. In the trial, patients receiving Gazyvaro demonstrated superior progression-free survival statistics compared to patients on MabThera-based therapy or the current standard of care. In the Phase 3 GALLIUM trial, patients treated with the Gazyvaro-based regimen demonstrated a reduction in the risk of disease progression or death (or progression-free survival) by 34%. The trial demonstrated that 80% of patients on the Gazyvaro-based therapy were progression-free compared to 73% patients on the MabThera-based regimen.

The recent regulatory approval and superior clinical data from the Phase 3 GALLIUM trial are expected to further push revenue growth of Gazyva. In the CLL market, Roche’s Gazyva competes with Teva Pharmaceutical’s (TEVA) Treanda, Johnson & Johnson’s (JNJ) Imbruvica, and Novartis’s (NVS) Arzerra. The growth in Gazyva sales could boost the share price of the Vanguard FTSE Developed Markets ETF (VEA). Roche makes up ~0.84% of VEA’s total portfolio holdings.