A Quick Look at Miners’ Technical Details

As of November 16, 2017, Alamos Gold, First Majestic Silver, Sibanye Gold, and AngloGold Ashanti had call-implied volatilities of 46.9%, 54.6%, 63%, and 40.9%, respectively.

Nov. 21 2017, Updated 12:58 p.m. ET

Miners’ technicals

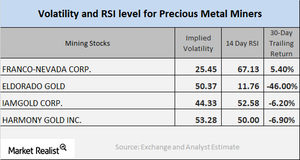

It’s important for investors to look at a few technical details of mining stocks, including their call-implied volatilities and RSI levels. In this part of the series, we’ll look at Alamos Gold (AGI), First Majestic Silver (AG), Sibanye Gold (SBGL), and AngloGold Ashanti (AU).

Call-implied volatility

Call-implied volatility is used to read the price fluctuations of a stock’s price with respect to changes in the stock’s call option. As of November 16, 2017, Alamos Gold, First Majestic Silver, Sibanye Gold, and AngloGold Ashanti had call-implied volatilities of 46.9%, 54.6%, 63%, and 40.9%, respectively. Mining stocks can be more volatile than their related precious metals.

RSI levels

RSI levels are used to assess whether a stock is overvalued or undervalued. If a stock’s RSI score is higher than 70, it might be overbought and its price might fall. If a stock’s RSI score is below 30, it could be oversold and its price might rise. AG and AGI have 30-day trailing losses, while SBGL and AU have 30-day trailing gains.

Alamos Gold, First Majestic Silver, Sibanye Gold, and AngloGold Ashanti have RSI scores of 43.8, 46.9, 59.3, and 63.8, respectively.

On a year-to-date basis, the VanEck Vectors Merk Gold ETF (OUNZ) and the PowerShares DB Gold ETF (DGL) have risen 10.6% and 9.8%, respectively.