Why Japan’s Services PMI Improved Solidly in October 2017

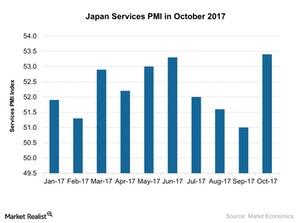

Japan’s services PMI (EWJ) (DXJ) rose solidly in October 2017. It stood at 53.4 in October 2017 compared to 51.0 in September 2017.

Nov. 16 2017, Updated 9:03 a.m. ET

Japan’s services PMI in October

According to the report provided by Markit Economics, Japan’s services PMI (EWJ) (DXJ) rose solidly in October 2017. It stood at 53.4 in October 2017 compared to 51.0 in September 2017. It met market expectations of 52.0. This was the strongest improvement since August 2015.

It was the 13th consecutive month of expansion in service activity. A level above 50 indicates expansion in activity, and a level below 50 indicates a contraction in activity. However, the September services PMI was the lowest reading since October 2016.

The stronger improvement in the October services PMI was mostly due to the stronger improvement in exports and new orders. Production output also improved at a higher rate in October as new orders showed a significant rise.

Job growth in the service sector also showed a significant rise in that month. Overall domestic demand and overseas (VT)(ACWI)(VTI) demand in the service sector rose in October.

Performance of ETFs

The iShares MSCI Japan ETF (EWJ) increased nearly 5.2% in October 2017. The WisdomTree Japan Hedged Equity ETF (DXJ) increased nearly 6.1% in October 2017.

The stronger performances of the major Japan-tracking ETFs in October 2017 indicate that business confidence improved strongly in that month. Businesses became more optimistic about the demand outlook of the country, which helped the Japanese equity market in that month.

In the next part of this series, we’ll analyze the performance of US consumer confidence in October 2017.