Insight into the Platinum Markets in November 2017

The gold-platinum ratio was ~1.4 on November 22, 2017.

Nov. 29 2017, Updated 11:31 a.m. ET

Short supply

The platinum market supply has been unable to match up to its demand over the past few years. The markets are expecting a 15,000-ounce short supply in 2017, which could further deepen to a whopping 275,000 ounces in 2018. Plus, 2018 would mark the sixth consecutive year of short supply.

The primary reason behind the drop in platinum supply is the decline in production (HL) in South Africa, which is the world’s largest producer of platinum. The deficits have also led to declining above-ground stocks held in vaults.

These shares gradually decreased after the five-month platinum mine strike in 2014, pushing the market into a deficit of 745,000 ounces in that year. Many of the platinum mining companies in South Africa also witnessed losses due to increasing labor costs and a stronger rand.

Spread analysis

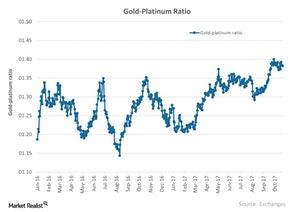

When analyzing the platinum markets (PPLT), it is important that we also compare its performance to gold (IAU), which is the most crucial of the precious metals. The comparative price performance between these two metals can be analyzed by way of the gold-platinum ratio, which indicates the number of platinum ounces needed to buy a single ounce of gold (AU)(AUY)(GG).

The gold-platinum ratio was ~1.4 on November 22, 2017. The RSI (relative strength index) level for the gold-platinum spread is 49.