Nike’s Fastest-Growing Demographic Segments

The women and young athletes demographic segments saw the greatest sales traction in fiscal 2015 for Nike.

Nov. 20 2020, Updated 2:37 p.m. ET

Wholesale channel thrives

Nike’s (NKE) results are closely tied to the performance of its wholesale partners. Sales from wholesale channels represented 76.5% of Nike’s revenues in fiscal 2015. Wholesale channel revenue rose 6.1% year-over-year to come in at $21.9 billion in fiscal 2015.

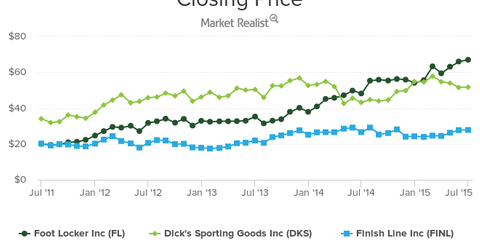

Nike’s wholesale partner Finish Line (FINL) also reported an upbeat quarter. It released results for 1Q16[1. Quarter ending May 30, 2015] on June 26. Same-store sales growth came in at 5.5% in the quarter. Results also beat expectations for both revenue and earnings. The company’s stock spiked 4.6% to $28.25 on June 26.

Foot Locker posts record earnings

Foot Locker (FL), another wholesale partner, reported record quarterly earnings last month. Upbeat earnings at the wholesale level are bullish indicators for Nike. We’ll discuss how futures orders in the wholesale channel are shaping up in part nine of this series.

Women and young athletes

The women and young athletes demographic segments saw the greatest sales traction in fiscal 2015. Both segments grew sales 15% in reported terms to $5.7 billion and $4.3 billion, respectively[1. Wholesale equivalent revenue]. In constant currency terms, revenue from the women and young athletes segments rose 20% and 19%, respectively.

These are the fastest growing demographic segments for Nike. The growing demand for “athleisurewear” and Nike’s own successful digital initiatives are powering sales for women’s wear.

Nike’s largest digital campaign for women launched in 4Q15. Called “Better For It,” the campaign garnered 18 million online views in two months, according to Trevor Edwards, president of Nike.

Nike also opened a number of women-only stores last year, including one in China and one in London. The company is targeting $7 billion in women’s gear sales by fiscal 2017.

Competition warms up

Nike’s wholesale partner Foot Locker has launched its own line of women’s wear, named SIX:02. Dick’s Sporting Goods (DKS), Nike’s second-largest wholesale channel, also debuted a new line of activewear for women last year called Calia by Carrie Underwood. DICK’s Sporting Goods expects Calia to become its third-largest athletic apparel brand in the future.

FL and DKS join a growing number of companies, including L Brands (LB) and The Gap (GPS) who’ve launched their own activewear brands. Others like Kohl’s (KSS) have announced tie-ups with yoga-wear firms to stock their apparel lines.

NKE, KSS, LB, GPS, FL, and DKS together constitute 4.9% of the portfolio holdings of the First Trust Consumer Discretionary AlphaDEX Fund (FXD).