How Weatherford Stock Moved in the Week Ended November 17

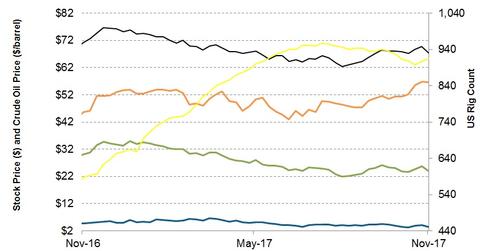

Weatherford International (WFT) stock fell 16.0% in the week ended November 17, 2017. The VanEck Vectors Oil Services ETF (OIH) generated a return of -6.0% during this period.

Nov. 20 2020, Updated 1:22 p.m. ET

Weatherford’s stock price movement

Weatherford International (WFT) stock fell 16.0% in the week ended November 17, 2017. The VanEck Vectors Oil Services ETF (OIH) generated a return of -6.0% during this period.

As a result, WFT has underperformed OIH in the past week. On November 17, the West Texas Intermediate (or WTI) crude oil price remained nearly unchanged versus the WTI crude oil price on November 10, 2017.

You can read more about what’s been happening in the energy market in Market Realist’s How Oil’s Decline Could Affect Your Investments.

Oilfield services companies like National Oilwell Varco (NOV) and TechnipFMC (FTI) have seen their stock prices decline in 2017 despite rising crude oil prices. You can read about FTI in Could Guidance Change Affect TechnipFMC in 2017?

Eight US rigs came online in the week ended November 17, 2017. Since November 18, 2016, the US rig count has increased 56%, led primarily by rising crude oil prices.

The Energy Select Sector SPDR ETF (XLE) has produced a -3.0% return since November 10, 2017. The SPDR S&P 500 ETF (SPY) also outperformed Weatherford International in the past week.

The Dow Jones Industrial Average (DJIA-INDEX) has remained unchanged in the week ended November 17, 2017.

What affected WFT’s returns in 3Q17?

Factors that affected Weatherford International’s 3Q17 returns include:

- increased revenues in WFT’s Well Construction, Completions, and Artificial Lift product lines

- lower cost structure in the US

- increased activity in the United States and Canada

- increase in completions-related work in Russia

You can read more about WFT in Market Realist’s WFT, FMSA, and SPN: Did Their 3Q17 Results Impress Investors? and What’s Keeping Weatherford Down despite Margin Improvement?

Next, we’ll discuss what WFT’s implied volatility means for its stock price.