Gauging Global Risk against Gold

All four precious metals rose on Monday, October 30, as multiple speculations in the market gripped investors’ attention.

Nov. 1 2017, Published 1:27 p.m. ET

News from the US

All four precious metals rose on Monday, October 30, as multiple speculations in the market gripped investors’ attention. The election of the next US Federal Reserve chair has been in the news, and the new tax policies have also taken center stage.

Notably, precious metals often climb with rising unrest in markets. The Trump administration has said that Fed governor Jerome Powell and Stanford University economist John Taylor are being considered for the Fed chair position, but it has also not ruled out renominating Janet Yellen.

[marketrealist-chart id=2420424]

Meanwhile, market participants aren’t sure whether President Trump’s new tax plan would actually benefit middle-income families and businesses very much, based on recent non-partisan research findings. If the administration’s tax plan makes it through the variously divided factions of Congress, it would be a contrary indicator for gold and silver, as their haven demands would be diminished.

Others factors that could play gold

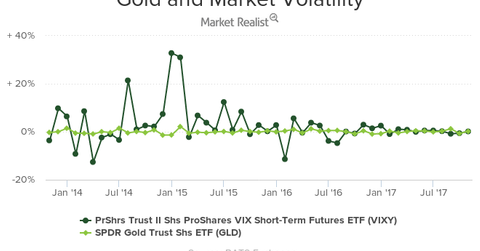

Economists have calculated that Trump’s tax cuts would lead to an increase in the nation’s budget deficit and expand the national debt. But such an increase in debt could be beneficial for safe havens like precious metals. The above chart depicts how gold (GLD) is reactive to the overall market volatility (VIXY).

Gold was buoyed on Monday based on the potential risks seen in the upcoming data this week. Eyes will be glued, of course, to the upcoming payroll data released on Friday as well as on the ongoing unrest in Catalonia.

Mining stocks had an up day on Monday. Among the top gainers were Eldorado Gold (EGO), Yamana Gold (AUY), Aurico Gold (AUQ), and B2Gold (BTG).