What to Expect from Crude Oil Prices

On November 9, US crude oil active futures rose 0.6% and closed at $57.17 per barrel. Geopolitical concerns in the Middle East could have helped crude oil.

Nov. 20 2020, Updated 10:51 a.m. ET

US crude oil

On November 9, 2017, US crude oil (USO) (USL) active futures rose 0.6% and closed at $57.17 per barrel. Geopolitical concerns in the Middle East could have helped crude oil’s rise.

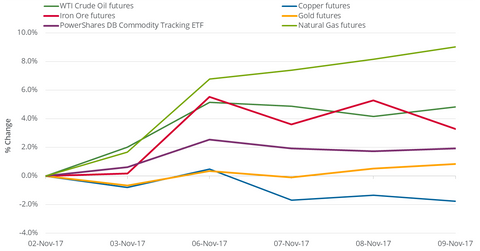

On November 2–9, 2017, US crude oil futures rose 4.8%. During this period, the S&P 500 Index (SPY) rose 0.2%, while the Dow Jones Industrial Average Index (DIA) fell 0.2%.

However, in the week ending November 3, 2017, US crude oil production rose to 9.62 million barrels per day—the highest weekly figure since 1983. It’s likely that higher oil prices might bring back the lost oil rigs since the week ending August 11, 2017. The recovery in the oil rig count could boost US crude oil production. A rise in US crude oil production could hamper global supply-demand dynamics and limit the upside in oil prices.

Natural gas

On November 9, 2017, natural gas (UNG) active futures rose 0.8% and closed at $3.2 per MMBtu (million British thermal units). On the same day, the U.S. Energy Information Administration reported natural gas inventory data. For the week ending November 3, 2017, natural gas inventories rose by 15 Bcf (billion cubic feet)—at par with the market’s expected rise.

On November 2–9, 2017, natural gas futures rose 9%. The bullish weather data could be behind the rise in natural gas.