China’s Auto Sales Might Have a Surprise Impact on Iron Ore

The Chinese automobile industry comes second, after the real estate sector, in consuming the most steel. In this article, we’ll look at the recent developments in this industry to track the associated iron ore demand.

Dec. 1 2017, Updated 9:01 a.m. ET

China’s auto demand

The Chinese automobile industry comes second, after the real estate sector, in consuming the most steel. In this article, we’ll look at the recent developments in this industry to track the associated iron ore demand.

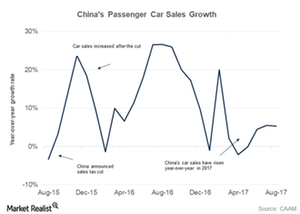

Auto sales on a weaker path

Auto sales (XLY) in China continue to elude big automakers. In October, total vehicle sales grew 2% compared to last October to 2.7 million units. Passenger-car sales recorded even weaker growth at just 0.4% year-over-year (or YoY) to 2.35 million units. For the first ten months of the year, passenger car sales have risen 2.1% YoY, which is a marked slowdown compared to growth of 15.9% in the same period last year. Total vehicles sales have risen 4.1% in January–October 2017.

While the China Association of Automobile Manufacturers was forecasting growth 5% in total vehicle sales for 2017, after weaker-than-expected October 2017 data, the association has warned that the growth target of 5.0% for 2017 probably won’t happen and growth likely won’t exceed ~4.0%.

Auto sales on a weaker path

A cut in the sales tax from 10% to 5% propelled the growth of the auto sector in 2016. While the incentive is still there, the rate has risen to 7.5%. The sales tax rate is slated to revert to 10% in 2018, prompting market participants to forecast higher sales for the last couple months of 2017 as consumers take advantage of lower sales tax. For the longer term, however, in the absence of any other incentives, growth in the auto sector might remain muted.

Lackluster growth in the property and auto markets doesn’t bode well for steel demand in China. These factors will also be negative for global steel (SLX) demand.

Lower steel demand is negative for iron ore demand, which impacts seaborne iron ore players such as Vale (VALE), Rio Tinto (RIO), Cleveland-Cliffs (CLF), and BHP Billiton (BHP).