Novartis in 2Q17: Performance of Innovative Medicines

The overall contribution of the Innovative Medicines segment was ~67.6% at $8.28 billion for 2Q17.

July 24 2017, Updated 2:35 p.m. ET

Innovative Medicines segment

Novartis’s (NVS) Innovative Medicines segment includes Novartis Pharmaceuticals and Novartis Oncology. The segment includes products from various therapeutic areas such as cardio-metabolic, dermatology, immunology, neuroscience, oncology, respiratory, retina, and established medicines.

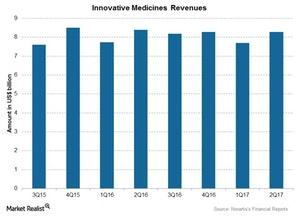

The above graph shows revenues for the Innovative Medicines segment over the last few quarters. The overall contribution of the segment was ~67.6% at $8.28 billion for 2Q17.

Performance of key products

Reported revenues include an operational growth of 1.0% for 2Q17, which consists of a 7.0% growth in sales volumes, partially offset by a 4.0% negative impact of generic competition and a 2.0% negative impact of pricing, mainly for Gleevec/Glivec in US and European markets.

Revenue growth for 2Q17 was driven by a strong performance of Cosentyx, Entresto, Promacta/Revolade, Jakavi, Tafinlar and Mekinist, Tasigna, Afinitor, and Xolair, partially offset by lower sales of Gleevec/Glivec and Sandostatin.

Gilenya, an oral drug for multiple sclerosis, reported an operational growth of 5.0% to $837.0 million in 2Q17, offset by a 2.0% negative impact of foreign exchange. Competitors for Gilenya include Tecfidera from Biogen (BIIB) and Aubagio from Sanofi (SNY).

The Tafinlar and Mekinist combination, approved for the treatment of BRAF (human gene B-Raf) V600+ metastatic melanoma, reported an operational growth of 28.0% in revenues to $216.0 million in 2Q17, compared to $172.0 million in 2Q16, due to the strong performance of the drug across all markets.

Tasigna, a drug for the treatment of chronic myeloid leukemia, reported an operational growth of 7.0% to $463.0 million in 2Q17, offset by a 6.0% negative impact of foreign exchange. Growth was driven by strong sales across the United States as well as outside the US markets. Competitors for Tasigna include Bosulif from Pfizer (PFE).

Lucentis, the ophthalmology drug, reported an operational growth of 5.0% in revenues to $477.0 million in 2Q17. Cosentyx, a monoclonal antibody, reported 90.0% operational growth in revenues to $490.0 million in 2Q17 compared to $260.0 million in 2Q16, following strong demand across all indications.

To divest the risk, you can invest in the First Trust Value Line Dividend ETF (FVD), which holds ~0.60% of its total assets in Novartis. FVD also holds 0.60% in Sanofi (SNY), 0.60% in GlaxoSmithKline (GSK), and 0.50% in Bristol-Myers Squibb (BMY).