Analysts’ Recommendations for GlaxoSmithKline in November 2017

Wall Street analysts estimate that GlaxoSmithKline’s (GSK) top line could fall 0.8% to ~7.5 billion pounds in 4Q17.

Dec. 6 2017, Updated 10:30 a.m. ET

Analysts’ estimates

Wall Street analysts estimate that GlaxoSmithKline’s (GSK) top line could fall 0.8% to ~7.5 billion pounds in 4Q17. GSK’s earnings per share (or EPS) are expected to reach 0.26 pounds for 4Q17.

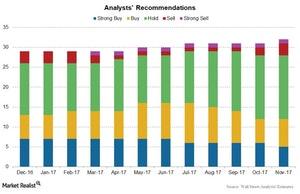

The chart below shows analysts’ recommendations for GlaxoSmithKline’s stock over the last 12 months. The increase in revenues is expected to be driven by the strong performance of its pharmaceutical products, vaccines, and consumer products.

The reported revenues could include the positive impact of foreign exchange due to the weakening of the pound sterling against all major currencies.

Analysts’ ratings

GlaxoSmithKline ADR’s price has fallen nearly 6.2% over last 12 months, and it has fallen ~6.7% in 2017 year-to-date. Analyst estimates show that the stock has a potential to return ~20.6% over the next 12 months.

Analysts’ recommendations show a 12-month targeted price of $43.33 per share compared to the last price of $35.92 per share on November 28, 2017.

Analysts’ recommendations

On November 28, 2017, four analysts tracked GlaxoSmithKline ADR listed on the NYSE. Of these analysts, one analyst recommended a “buy” while three analysts recommended a “hold.” None of the analysts recommended a “sell.” The consensus rating for GlaxoSmithKline stands at 2.5, which represents a moderate buy for value investors.

Thirty-two analysts track GlaxoSmithKline stock listed on London Stock Exchange. Of these analysts, 12 recommended a “buy,” 16 analysts recommended a “hold,” and four analysts recommended a “sell,” as shown in the graph above.

The Vanguard FTSE Developed Markets ETF (VEA) holds 9.0% of its total investments in healthcare companies. VEA holds 0.4% in GlaxoSmithKline Plc (GSK), 0.4% in Novo Nordisk (NVO), 0.5% in Sanofi (SNY), and 1.0% in Novartis AG (NVS).