What Analysts Recommend for NetApp

Of the 27 analysts covering storage technology (QQQ) company NetApp (NTAP), 13 gave it a “buy” recommendation, two recommended a “sell,” and 12 recommended a “hold.”

Aug. 18 2020, Updated 5:26 a.m. ET

Analyst recommendations

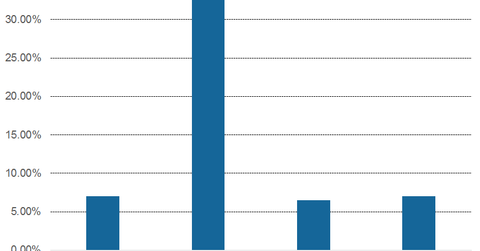

Of the 27 analysts covering storage technology (QQQ) company NetApp (NTAP), 13 gave it a “buy” recommendation, two recommended a “sell,” and 12 recommended a “hold.” The analyst stock price target for the company is $47.8 with a median target estimate of $49.5. NetApp is trading at a discount of 7% to median analyst estimates.

Peer storage companies such as Western Digital (WDC), IBM (IBM), and Seagate (STX) are trading at discounts of 33%, 6.5%, and 7%, respectively, to median analyst estimates.

Barclays and UBS recently upgraded NetApp

NetApp stock rose 1.3% in pre-market trading on November 9, 2017. Investment bank Barclays (BCS) upgraded NetApp to “overweight” from “underweight” and expects higher valuation multiples driven by improvement in profit margins and free cash flows. Barclays expects NetApp to increase its market share in business verticals such as all-flash arrays. Barclays increased the 12-month price target on NetApp to $52 from $38.

Last month, UBS Capital also upgraded NetApp to a “buy” from “hold” and then raised the 12-month price target on NetApp to $45 from $42. UBS is optimistic about NetApp’s execution over the long term and expects an improvement in product sales as well. In October 2017, Drexel Hamilton reiterated its “buy” rating on NetApp with a 12-month price target of $62.