How Did Apple Perform in Fiscal 4Q16?

On October 25, 2016, technology heavyweight Apple (AAPL) announced its fiscal 4Q16 results. It reported revenue of $46.9 billion and quarterly net income of $9 billion, with earnings per share of $1.68.

Nov. 1 2016, Updated 10:18 a.m. ET

Revenue of $46.9 billion in fiscal 4Q16

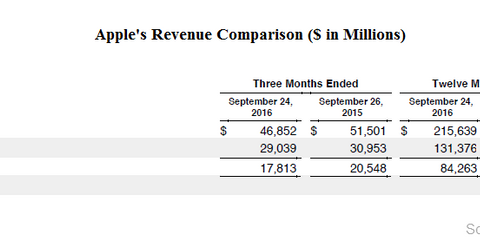

On October 25, 2016, technology (QQQ) heavyweight Apple (AAPL) announced its fiscal 4Q16 results. It reported revenue of $46.9 billion and quarterly net income of $9 billion, with EPS (earnings per share) of $1.68.

In comparison, in fiscal 4Q15, Apple announced revenue of $51.5 billion and net income of $11.1 billion, with EPS of $1.97. Revenue fell 9% YoY (year-over-year), due to lower product sales and a 30% decline in sales in Greater China.

“Our strong September quarter results cap a very successful fiscal 2016 for Apple,” said Apple CEO Tim Cook. “We’re thrilled with the customer response to iPhone 7, iPhone 7 Plus and Apple Watch Series 2, as well as the incredible momentum of our Services business, where revenue grew 24 percent to set another all-time record.”

Analysts expected revenue of $46.8 billion

Analysts expected the company to post revenue of $46.8 billion for the quarter, with a low estimate of $45.6 billion and a high estimate of $48.3 billion. Apple’s EPS are expected to be $1.65, with a high estimate of $1.73 and a low estimate of $1.57.

Whereas peers Western Digital (WDC) and Seagate Technology (STX) announced their latest fiscal quarter’s results on October 26 and October 19, respectively, HP (HPQ) will be announcing its results on November 22, 2016.