Johnson & Johnson’s Medical Devices Segment in 2Q17

Medical devices segment Johnson & Johnson’s (JNJ) medical devices segment reported revenue of $6.7 billion in 2Q17, a growth of 4.9% from the revenue of $6.4 billion reported in 2Q16. This figure included 5.9% growth in operating revenue, and was partially offset by a 1% foreign exchange impact. Cardiovascular care franchise The cardiovascular care franchise […]

Aug. 30 2017, Updated 7:36 a.m. ET

Medical devices segment

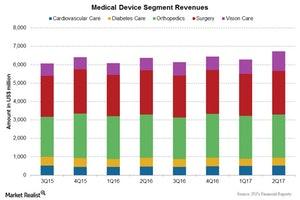

Johnson & Johnson’s (JNJ) medical devices segment reported revenue of $6.7 billion in 2Q17, a growth of 4.9% from the revenue of $6.4 billion reported in 2Q16. This figure included 5.9% growth in operating revenue, and was partially offset by a 1% foreign exchange impact.

Cardiovascular care franchise

The cardiovascular care franchise reported revenue of $523 million in 2Q17, 11.3% growth from 2Q16. This growth was driven by increased sales in the electrophysiology business, specifically of Thermocool catheters.

Diabetes care franchise

The diabetes care franchise reported revenue of $421 million in 2Q17, a 10.6% decline from 2Q16. The decline in sales was due to pricing pressure and competition from new pumps in the market.

Orthopedics franchise

The orthopedics franchise reported revenue of $2.3 billion in 2Q17, a 0.5% decline from 2Q16. The decline was due to lower sales of Spine products, and partially offset by hips, knee, and trauma products.

Surgery franchise

The surgery franchise reported revenue of $2.4 billion in 2Q17, a 0.5% decline from 2Q16. Lower sales of endomechanical, general surgery, Sterilmed, advanced sterilization, and Mentor products were partially offset by strong sales of endocutters, energy, and biosurgery products in advanced surgery, and sutures in general surgery products.

Vision care franchise

The vision care franchise reported revenue of $1.1 billion in 2Q17, 54% growth from 2Q16. The growth was driven by the inclusion of products from Abbott Medical Optics, as well as its new DEFINE and OASYS 1-Day products.

To divest company-specific risks, investors could consider the VanEck Vectors Pharmaceutical ETF (PPH) which has a 9.2% exposure to Johnson & Johnson (JNJ). PPH also holds 6.9% of its total assets in Novartis (NVS), 5.6% in Novo Nordisk (NVO), and 5.2% in Sanofi (SNY).