Will China’s Steel Production Take the Sheen Away from Iron Ore Prices?

The most-traded January rebar contract on the Shanghai Futures Exchange climbed 4.3% to 3,776 yuan per ton.

Oct. 30 2017, Updated 10:34 a.m. ET

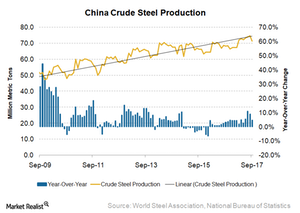

China’s steel production

As we discussed earlier in this series, Chinese steel production has been buoyant in 2017, mostly on the back of higher steel prices. Steel mills are taking advantage of higher margins to produce as much as they can.

China’s crackdown and the steel outlook

The production curbs put in place in China have been helping the country’s steel prices. While the scheduled cuts are expected to come into effect mid-November onward, some plants in northern cities have been asked to cut production a month ahead of schedule. This action led the spot and steel futures in China to surge.

The most-traded January rebar contract on the Shanghai Futures Exchange climbed 4.3% to 3,776 yuan per ton. This rally also lifted prices for raw materials such as iron ore, coking coal, and nickel.

Commonwealth Bank of Australia analyst Vivek Dhar noted, “Market participants felt that authorities could impose stricter restrictions on sintering and even steel output in China in coming days as smog conditions deteriorate in northern China.”

While the impending steel capacity cuts have fueled steel prices in recent months, it may not remain the same for the coming months. Steel demand usually wanes during the winter months. Weaker steel demand can still be accommodated through the lower steel capacity in place, which could subdue steel prices.