Why Many Analysts Aren’t Positive on Ford in October 2017

According to data compiled by Reuters as of October 11, 25% of analysts covering Ford (F) stock have given it a “buy” recommendation.

Oct. 13 2017, Updated 4:06 p.m. ET

Recommendations on Ford

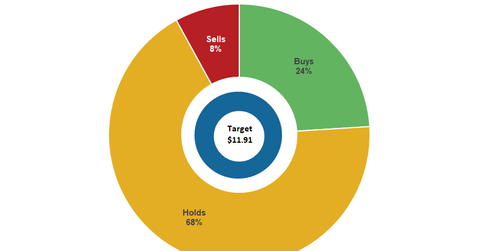

According to data compiled by Reuters as of October 11, 25% of the 24 analysts covering Ford (F) stock have given it a “buy” recommendation. Another 67% have recommended a “hold,” while the remaining 8% of analysts have given “sell” recommendations.

Upside potential for Ford stock

On October 11, 2017, Ford’s consensus 12-month target price was $11.91. This price target was already lower than its market price of $12.38. In the last few quarters, the company’s profitability has fallen, which could be the key reason why not many analysts are positive on its stock at the moment. In September, Ford stock yielded its highest returns in the last 22 months of about 8.5%.

With this, the company managed to outperform the broader market in 3Q17. The company has underperformed the S&P 500 Index (SPY) and the stocks of other mainstream automakers for the last four consecutive quarters. On a year-to-date basis, Ford stock has risen ~2.1% as of October 11.

Recent updates

In 3Q17, Wall Street analysts expect Ford’s adjusted EPS (earnings per share) to be at $0.33 with about a 25% year-over-year increase. Investors could be concerned about how the company will manage to protect its 3Q17 profit margins at a time when US auto sales are weakening.

Auto giants (IYK) including Ford, General Motors (GM), Fiat Chrysler (FCAU), and Toyota (TM) make a large percentage of their revenues from the US. Previously, in 2Q17, Ford’s adjusted EPS (earnings per share) were at $0.56, which reflected about a 7.7% rise as compared to its adjusted EPS of $0.52 in 2Q16.

On October 3, Ford’s CEO, Jim Hackett, updated investors on the company’s plans to focus on new high growth potential business areas such as autonomous vehicles, electric vehicles, and personal mobility. He also revealed that Ford has recently invested in a tech startup named Autonomic to build an “open platform for transportation” services.

In the next part, we’ll look at analysts’ recommendations for Tesla (TSLA) in October 2017.