Exploring Intuitive Surgical’s Sales Model

Intuitive Surgical follows a diversified sales strategy and doesn’t generate more than 10% of its revenue through any one customer.

May 28 2016, Updated 8:06 a.m. ET

Overview

In the United States, Japan, South Korea, and most of Western Europe excluding Portugal, Italy, Spain, and Greece, Intuitive Surgical (ISRG) sells its products through a direct sales model. In the rest of the world, the company provides its products through distributors.

Intuitive Surgical follows a diversified sales strategy and doesn’t generate more than 10% of its revenue through any one customer. Major medical device companies including Medtronic (MDT), Becton Dickinson (BDX), and Stryker (SYK) also focus on a diversified sales and marketing employee force for worldwide market penetration.

Investors can gain diversified exposure to Intuitive Surgical by investing in the Vanguard Growth ETF (VUG). VUG holds ~0.26% of its total holdings in ISRG.

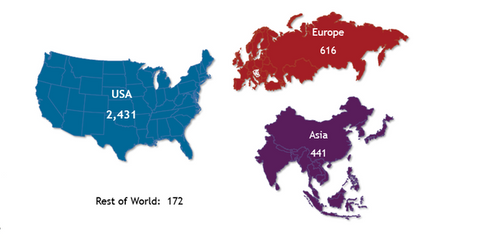

The above diagram shows the da Vinci surgical system installed base around the world. In 2015, around 71% of its revenue was generated from US sales. Thus, direct sales organization is an important focus area for Intuitive Surgical.

Direct sales model

The company’s direct sales model comprises a capital sales team and a clinical sales team. The capital sales team is responsible for the sale of da Vinci surgical systems. The clinical sales team is responsible for the support activities for performing surgical procedures using da Vinci at hospitals, including individual hospitals and those that are part of an integrated delivery network.

The capital sales team educates hospital staff and surgeons about the benefits of the da Vinci surgical system across medical specialties, the total cost of treatment, and the clinical applications and benefits of the system. One of these benefits is increased patient volume.

The clinical sales team works on-site and establishes relationships with the hospital staff and administration to develop sustained surgery programs. The team provides information on robotic surgery practices and new applications.