Why Expectations for Business Conditions Fell 50% in September

The October Conference Board LEI reported that average consumer expectations for business conditions for September are 0.37 above the mean.

Oct. 30 2017, Updated 9:01 a.m. ET

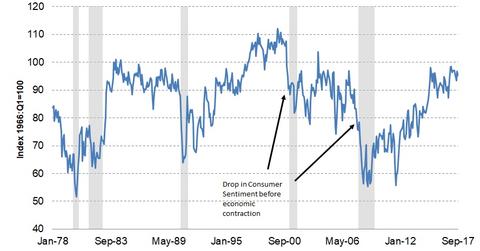

Consumer expectations for business conditions

The Conference Board Leading Economic Index (or LEI) is, as the name suggests, an economic index constructed by using leading indicators. The only exception to this rule is the inclusion of consumer expectations. Consumer expectations aren’t leading indicators since consumers usually react after the economy has improved or if the economy is in a recession.

This indicator is based on consumer expectations collected from two surveys. One of these surveys is conducted by the University of Michigan and Reuters, where consumer expectations for economic conditions for a period of 12 months ahead are collected. The second survey is conducted by the Conference Board, which records consumer expectations for business conditions for six months ahead. The average of these two surveys is used in the LEI.

Recent data

The October Conference Board LEI reported that average consumer expectations for business conditions for September are 0.37 above the mean. That reading fell 50.0% compared to the August reading of 0.70. The sudden fall in consumer expectations could have been influenced by the recent hurricanes in the southern part of the United States. That may not be a cause for concern since the fall in consumer expectations could be viewed as a one-off impact after the hurricanes.

Going forward, tax cuts and tax reforms are likely to boost consumer expectations since they will increase disposable income for the working class.

Conclusion

The LEI has been an excellent predictor of change in business cycles. The October report is constructed using data from September. Although there has been a marginal fall in the index value, it should not be considered a reason to worry.

There have been a few important developments in the last three weeks that could lead to higher levels of optimism for the markets (QQQ). Lower levels of volatility (VXX) could be expected in the equity markets (SPY), but the currency (CEW) and bond (SHY) markets may not be subjected to the changing of the guard at the Fed and the developments around US tax reforms.

The next Conference Board Leading Economic Index should be released on Monday, November 20, 2017.