What Analysts Project for Global HDD and SSD Shipments

According to Statista, HDD (hard disk drive) shipments are expected to fall 7% YoY (year-over-year) in 2017 to 395 million units from 425 million units in 2016.

Oct. 6 2017, Updated 9:11 a.m. ET

HDD shipments expected to fall again in 2017

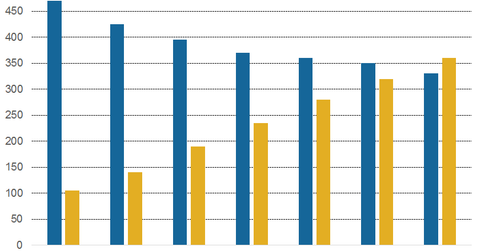

According to Statista, HDD (hard disk drive) shipments are expected to fall 7% YoY (year-over-year) in 2017 to 395 million units from 425 million units in 2016. HDD shipments were 470 million units in 2015. As the graph below shows, HDD shipments are expected to fall year-over-year until 2021 to 330 million units. This fall is likely to impact the revenues of the top HDD manufacturers over the next few years. Western Digital (WDC), Seagate (STX), and Japan’s (EWJ) Toshiba (TOSYY) are the major HDD manufacturers with market shares of 41%, 37%, and 22%, respectively.

SSD growth to offset HDD decline

While HDD shipments are likely to fall over the next few years, storage firms can try to improve penetration in the SSD (solid state drive) markets. Statista has estimated SSD shipments will rise 36% YoY to 190 million units in 2017, up from 140 million units in 2016. SSD shipments are also expected to rise 24% YoY to 235 million units in 2018, 19% YoY to 280 million units in 2019, and 14% YoY to 320 million units in 2020. SSD shipments are expected to overtake HDD shipments in 2021 as total SSD units are expected to reach 360 million.

Although HDD shipments have fallen since 2015, Seagate and Western Digital have a portfolio of storage products to offset this decline. In fiscal 4Q17, Seagate shipped 62 exabytes, while WDC shipped over 81 exabytes. Both rose on a YoY basis.