Did Weatherford Stock Fall in the Week to October 6?

Since the week ending September 29, 2017, Weatherford International stock has fallen 7% until October 6, 2017. OIH has generated -2% returns.

Dec. 4 2020, Updated 10:53 a.m. ET

Weatherford’s stock price

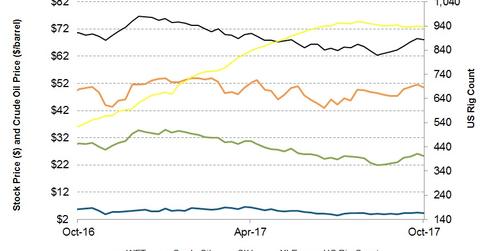

Since the week ending September 29, 2017, Weatherford International (WFT) stock has fallen 7% until October 6, 2017. The VanEck Vectors Oil Services ETF (OIH) has produced -2% returns during this period. So, Weatherford has underperformed OIH in the past week. On October 6, 2017, the West Texas Intermediate crude oil price fell 2%—compared to the price on September 29, 2017. To learn more about the energy market, read Reading the Impact of Oil Prices on Your Energy Investments.

National Oilwell Varco (NOV) and Halliburton’s (HAL) stock prices have fallen in 2017, despite a relatively steady crude oil price. Four US rigs were lost in the past week until October 6, 2017. Since October 6, 2016, the US rig count has risen 79% due to steady crude oil prices.

The Energy Select Sector SPDR ETF (XLE) has produced -1% returns since September 29, 2017. The SPDR S&P 500 ETF (SPY), which generated a 1% return, also outperformed Weatherford during this period. The Dow Jones Industrial Average (DJIA-INDEX) rose 2% in the past week until October 6, 2017.

What could impact Weatherford’s returns in 3Q17?

- Weatherford’s 3Q17 revenue is expected to increase from the Europe, Caspian, Russia, and sub-Saharan Africa region as a result of higher activity levels in the North Sea.

- Weatherford’s North America business will likely grow, led by Canada’s recovery from the spring breakup and new contract commencement in the US.

- Weatherford’s Middle East, North Africa, and Asia-Pacific region’s operating margin could remain flat in 3Q17 due to higher project startup costs and an unfavorable change in the geographic mix.

To learn more about Weatherford, read What’s Keeping Weatherford Down despite Margin Improvement? and Weatherford International: Valuation, Analyst Targets, and More.

In the next part, we’ll discuss what Weatherford’s implied volatility means for its stock price.