The Reaction of Precious Metals on October 11

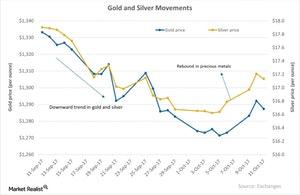

The last few days have seen a rise in precious metal prices. However, on Wednesday, October 11, 2017, the prices of these loved metals fell.

Oct. 13 2017, Published 5:14 p.m. ET

A down day for precious metals

The last few days have seen a rise in precious metal prices. However, on Wednesday, October 11, 2017, the prices of these loved metals fell. Gold, silver, and platinum fell 0.37%, 0.43%, and 0.33%, respectively, that day, while palladium rose 2.7%.

Gold futures for November expiration were 0.37% lower for the day and ended at $1,287.30 per ounce. Silver futures for December delivery ended 0.43% lower to close at $17.10 per ounce. Call-implied volatility in silver rose to 17.9%, while gold’s call-implied volatility was 10.2%. Call-implied volatility is a measurement of the fluctuations in the price of a stock with respect to changes in the price of the call option.

Korean tensions

The changes in precious metals are also impacted by the overall volatility and risk element in the market. On Tuesday, October 10, 2017, the United States flew two B-1 aircraft over the Korean Peninsula, and President Donald Trump held a meeting with top defense officials to discuss how to respond to any threats from North Korea. However, these events didn’t have a profound impact on the market as havens stayed low and the dollar fell on Wednesday.

The ups and downs in the market are known to have a positive play on gold. However, that didn’t happen on Wednesday, and the havens fell. The fall in precious metals didn’t affect mining funds. The Global X Silver Miners ETF (SIL) and the VanEck Vectors Gold Miners ETF (GDXJ) rose 1.0% and 1.2%, respectively, that day.

Mining shares that rose included Kinross Gold (KGC), Iamgold (IAG), Coeur Mining (CDE), and Pan American Silver (PAAS), which rose 2.1%, 1.1%, 1.1%, and 0.98%, respectively.