Mining Stocks so Far in 2017: A Correlation Study

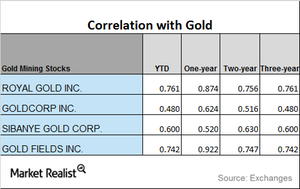

Among these four mining stocks, Goldcorp has the lowest correlation with gold on a YTD basis, while Royal Gold (RGLD) has the highest correlation.

Oct. 10 2017, Published 4:58 p.m. ET

Correlation analysis

When reading the precious metal industry and considering investments in mining funds and stocks, it’s vital to do a correlation study.

For this correlation analysis, we’ll compare Royal Gold (RGLD), Goldcorp (GG), Sibanye Gold (SBGL), and Gold Fields (GFI).

Mining stocks strongly correlate with their respective precious metals, and some of the funds that rise and fall with gold and silver include the iShares MSCI Global Gold Min (RING) and Global X Silver Miners (SIL). These two funds have seen YTD (year-to-date) gains of 9.9% and 4.9%, respectively.

Correlation with gold

Among the above mining stocks, Goldcorp has the lowest correlation with gold on a YTD basis, while Royal Gold (RGLD) has the highest correlation. Over the past three years, Gold Fields and Goldcorp have seen rising trends in their correlations to gold, while Royal Gold and Sibanye have seen mixed patterns in their correlations with gold.

Gold Fields has a three-year correlation of 0.74 with gold and a one-year correlation of 0.92. This correlation of 0.92 suggests that almost 92.0% of the time during the past year, Gold Fields has moved in the same direction as gold.