The Market Sentiment for Coeur Mining as 4Q17 Begins

CDE stock has risen 2.6% year-to-date. However, during the same period, silver prices gained 4.7% and the Global X Silver Miners ETF (SIL) rose 5.5%.

Nov. 20 2020, Updated 3:52 p.m. ET

Market sentiment for Coeur Mining

Coeur Mining’s (CDE) operational performance year-to-date (or YTD) has been weak. Its stock has also underperformed its silver peers in 2017. CDE stock has risen 2.6% until October 6, 2017. However, during the same period, silver prices gained 4.7% and the Global X Silver Miners ETF (SIL) rose 5.5%.

Its production growth and unit cost improvement have lagged behind market expectations. Historically, Coeur Mining (CDE) has been a high-cost producer compared with its peers (SIL) First Majestic Silver (AG), Hecla Mining (HL), and Tahoe Resources (TAHO). Because of higher costs, the company has higher operational leverage compared to its peers, which makes it more sensitive to changes in gold and silver prices.

Coeur Mining’s latest results were slightly below market expectations. CDE also downgraded its 2017 production guidance slightly.

Analysts’ recommendations

Among the primary silver producers, Coeur Mining (CDE) has the highest percentage of “buy” recommendations at 56%. Another 44% recommend a “hold” for the stock, and there were no “sell” ratings on the stock.

CDE’s upside potential based on the current target price of $11.60 is 26.6%. CDE’s stock price has seen a downward revision of 12% YTD. This decline is mainly due to the company’s poor operational performance.

Analyst estimates

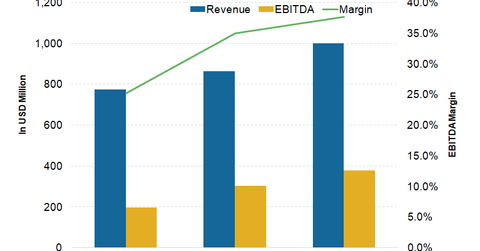

According to Thomson Reuters data, Coeur Mining (CDE) is expected to have revenues of $191.5 million in 3Q17, implying a rise of 8.6% year-over-year (or YoY) and 10.5% sequentially. The consensus estimate for 2017 is $774.0 million. This estimate implies a rise of 16.2% YoY.

Investors should note that this estimate is substantially higher than Coeur Mining’s actual revenue rise of 3.0% in 2016. The expected rise in 2017 is due to Coeur Mining’s guidance for a production increase of 9% at the midpoint.

While Coeur Mining’s revenues are expected to head higher in 3Q17, its EBITDA[1. earnings before interest, tax, depreciation, and amortization] is estimated to fall 19.7% YoY. The consensus expectation for its EBITDA is $194.6 million in 2017, which implies an annual decline of 9.5%.

Coeur Mining’s EBITDA decline is expected despite a revenue increase. This decline is mostly due to higher cost expectations for the miner in 2017. Coeur Mining has guided for higher costs at its Wharf mine. Because CDE’s EBITDA is expected to decline along with a rise in revenues, its margin projection for 2017 is 25.1% compared with 32.3% in 2016.

Going forward, Coeur Mining’s costs should decline as the Wharf mine enters the high-grade area and Palmarejo’s production ramps up. Analysts expect a margin of 35.0% in 2018 and 37.7% in 2019.