Janet Yellen Balance Sheet Strategy a Closer Look

Fed Chair Janet Yellen, in her speech at the 2017 Herbert Stein Memorial Lecture, offered some more insight into the Fed’s balance sheet reducing strategy.

Nov. 1 2017, Updated 9:03 a.m. ET

Guidance was the key

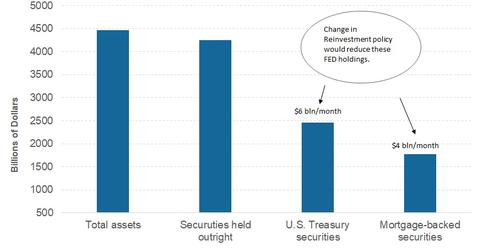

Fed Chair Janet Yellen, in her speech at the 2017 Herbert Stein Memorial Lecture, offered some more insight into the Fed’s balance sheet reducing strategy. She pointed out that the Fed guidance that the FOMC would eventually start a gradual and predictable reduction of the Fed’s reserves has helped limit the impact of this move on the markets. The US FOMC, in its June policy statement addendum, clearly stated that it plans to reduce its balance sheet holding. But it didn’t specify when the program would begin.

Impact on the bond markets

Yellen said that the estimates of the effect of the Fed’s security holdings on long-term interest (TLT) rates are uncertain. She referred to a recent study that indicated 1% downward pressure on the ten-year (IEI) yield. This pressure on yields is expected to reduce slowly as the Fed goes ahead with its gradual normalization plans.

This normalization process could take many years, and any impact on the market would be minimal. The key factor to watch out for would be the forward rate guidance for short-term (SHY) interest rates, which are expected to rise by at least another 100 to 125 basis points.

Are there any risks for balance sheet normalization?

Yellen said that the pace of the normalization process is likely to have limited impact on bond (BND) yields. Yellen claimed that the Fed isn’t selling its assets but is only reinvesting part of the maturing securities each month. Having communicated this move clearly in advance, the Fed has managed to limit volatility (VXX) in the financial markets.