Eurozone Inflation Is Improving: Why Is ECB Still Dovish?

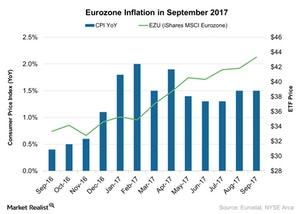

On a year-over-year basis, the Eurozone Inflation (VGK) (IEV) (EZU) Index stood at 1.5% in September 2017, the same as in August 2017.

Oct. 31 2017, Updated 4:55 p.m. ET

Eurozone inflation in September

On a year-over-year basis, the Eurozone Inflation (VGK) (IEV) (EZU) Index stood at 1.5% in September 2017, the same as in August 2017, according to data provided by the Eurostat. The index met the initial estimate of 1.5%.

The inflation figure in September was mainly due to a stronger improvement in food prices. However, the prices of energy, alcohol, and tobacco rose at a softer pace in September 2017. The core inflation, which is an important indicator for the European Central Bank in its policy decisions, excludes energy, tobacco, and unprocessed food. Core inflation was at 1.1% in September as compared to 1.2% in August 2017.

The ECB’s decision

The European Central Bank (or ECB) declared its monetary policy review decision on Thursday, October 26, 2017. It declared that the central bank will continue the bond-buying program until September 2018. However, it decided to reduce the level of bond purchases from 60 billion euros to 30 billion euros. The dovish stance taken by the ECB weakened the euro’s (FXE) movement against the US dollar (UUP) on that day.

ECB president Mario Draghi’s comment indicated that the monetary policy decision was aimed at maintaining a suitable financial condition in the economy. However, all the fundamental factors such as inflation, economic growth, manufacturing PMI, services PMI, and the Economic Sentiment Index are improving, thus signaling a stronger economy.

In the next part of this series, we’ll analyze US retail sales in September 2017.