Factors Driving Analysts’ Forecast of a Drop in CLF’s Net Debt in 2017

According to consensus estimates, CLF’s net debt should fall 42% by the end of 2017 compared to 2016.

Oct. 18 2017, Updated 9:08 a.m. ET

Financial leverage

Although investors are still concerned about Cleveland-Cliffs’ (CLF) debt, the concern has diminished greatly. The company’s new management took over in 2014 with a priority of debt reduction with proceeds from any source.

Cleveland-Cliffs’ total debt at the end of 2Q17 was $1.6 billion, and its net debt was $1.3 billion. This debt level was significantly lower than the net debt of $2.3 billion the company reported at the end of 2Q16.

During its 2Q17 earnings call, CLF noted that based on its EBITDA[1. earnings before interest, tax, depreciation, and amortization] and another outlook, the net debt should be lower than $1 billion.

Liquidity position comfortable

Cleveland-Cliffs (CLF) also lowered its maturity wall, which was a notable threat to its sustainability. Although this debt was due in 2020 and 2021, it is scheduled to start maturing in 2025. CLF had $321 million in cash at the end of 2Q17 with total liquidity of $536 million.

According to consensus estimates, CLF’s net debt should fall 42% by the end of 2017 compared to 2016.

Net debt-to-forward-EBITDA ratio

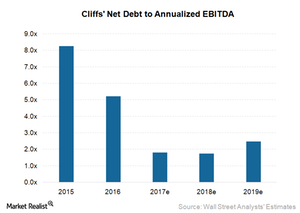

A company’s net debt-to-forward-EBITDA ratio reflects the number of years it would take to completely pay off its debt only from its EBITDA.

As Cleveland-Cliffs’ EBITDA improved and its management sharpened its focus on debt reduction, this ratio fell significantly in 2016 compared to 2015. It had a net debt-to-forward-EBITDA ratio of 5.2x at the end of 2016, which was a significant improvement compared to its net debt-to-forward-EBITDA ratio of 9.0x at the end of 2015.

Currently, analysts estimate this ratio to improve to 1.8x by the end of 2017.

Other US (VTI) (DOW) steel companies (SLX) with high financial leverage—including ArcelorMittal (MT), AK Steel (AKS), and U.S. Steel Corporation (X)—have also made successful efforts to reduce their debt levels.