Consumer Sector Insights for the First Week of 2018

The consumer staples sector had a slight gain of 0.10% led by a stock increase in the stock price of CVS Health, Coty, Estee Lauder, and Walmart.

Jan. 10 2018, Published 9:01 a.m. ET

Market and consumer sector’s performance last week

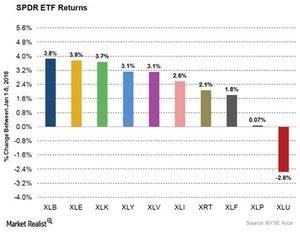

The S&P 500 Index (SPY) (SPX-Index) ended the first week of 2018 on a positive note due to an impressive performance from most of the sectors. Besides the utility sector, all the other areas had positive growth in the week ending January 5, 2018.

The consumer staples sector and consumer discretionary sector’s stock got a boost in the first week of the year due to brokerage firm analysts’ recommendations and an increased target price.

The consumer staples sector had a slight gain of 0.10% led by a stock increase in the stock price of CVS Health (CVS), Coty (COTY), Estee Lauder (EL), and Walmart (WMT). Analysts upgraded and increased the stocks’ target prices.

The consumer discretionary sector rose 3.2% last week. Retailers and department stores’ shares rose due to analysts’ optimistic views.

Consumer sector-based ETFs had a productive first week of the year. Led by retailers and department stores’ gain last week, the SPDR S&P Retail ETF (XRT) rose 2.1%. The Consumer Discretionary Select Sector SPDR Fund (XLY) rose 3.1%. The Consumer Staples Select Sector SPDR ETF (XLP) reported a slight increase of 0.07%.