Can Cleveland-Cliffs’ Realized Prices in the US Recover in 2018?

For 3Q17, Cleveland-Cliffs reported average realized prices came in at $90.50 per ton.

Oct. 27 2017, Updated 7:34 a.m. ET

US realized prices

As we discussed in the previous part of this series, realized prices along with volumes drive a company’s revenues. Cleveland-Cliffs’ (CLF) US Iron Ore’s (or USIO) realized revenues are influenced by customers’ demand for iron ore pellets.

Customer mix, industrial commodity (DBC) prices, energy prices (USO), production costs, freight rates, and hot rolled band steel prices are among the factors influencing CLF’s realized revenues.

Realized revenues drop

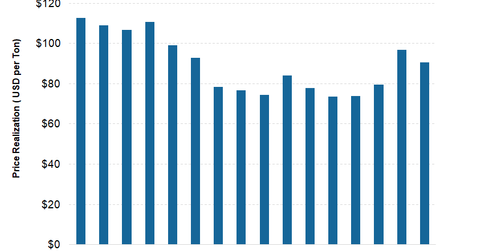

For 3Q17, Cleveland-Cliffs reported average realized prices came in at $90.50 per ton. Although the realization implies a fall of ~$6.00 per ton quarter-over-quarter, it is still an improvement of $17.00 per ton as compared to the third quarter of 2016.

The sequential decline in realizations is due to the unfavorable customer mix, higher benchmark freight, timing of contracts, and lower full-year estimates for iron ore and US steel prices. The management was guiding for higher realized revenues for second-half as compared to the first half of 2017.

Future expectations for realizations

As we discussed in the previous part of this series, one of Cleveland-Cliffs’ major customers reduced its pellet nominations. This led Cleveland-Cliffs to put more pellets in the export market than it had previously expected, which impacted the price received for the material. This also entailed higher freight rates.

This trend is expected to continue through 4Q17. For 2018, however, the company is optimistic regarding the domestic demand and realizations as such. Cleveland-Cliffs’ CEO, Lourenco Goncalves, noted that for 1Q18 steel mills are optimistic. He cited an increase of ~$40.00 per ton in steel prices by steelmakers as evidence of higher expected demand.

Higher future realizations for Cleveland-Cliffs is a positive read-through for US steelmakers (SLX), including AK Steel (AKS), Nucor (NUE), U.S. Steel (X), and ArcelorMittal (MT).

In the next part of this series, we’ll discuss Cleveland-Cliffs’s Asia-Pacific division.