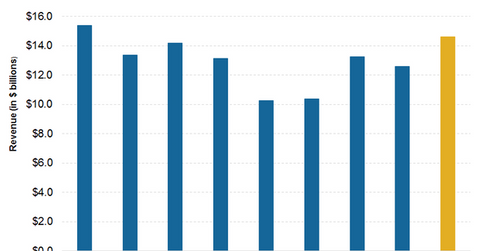

Analysts Expect Peabody Energy’s Revenues to Rise in 3Q17

In 3Q15, Peabody Energy (BTU) reported $1.42 billion in revenues. Analysts anticipate that it will post $1.46 billion in 3Q17 compared to $1.26 billion in 2Q17.

Dec. 4 2020, Updated 10:53 a.m. ET

Peabody Energy’s revenue estimates

In 3Q15, Peabody Energy (BTU) reported $1.42 billion in revenues. Analysts anticipate that it will post $1.46 billion in 3Q17 compared to $1.26 billion in 2Q17. The estimated revenues are 16.0% higher than 2Q17 revenues.

In the United States, most thermal coal is used for electricity production, which changes based on seasonal demand. So it’s logical to consider year-over-year revenue data to account for seasonal differences instead of comparing quarter-over-quarter results.

Coal production

According to the short-term energy outlook reported by the EIA (U.S. Energy Information Administration), coal production in the primary US coal-producing (KOL) regions from January 2017 to September 2017 was 591.0 MMst (million short tons), a rise of 12.0% compared to the corresponding period in 2016.

A consistent increase in coal production may imply higher volumes for BTU and its peers Westmoreland Coal Company (WLB), Arch Coal (ARCH), and Cloud Peak Energy (CLD).

The vast majority of Peabody Energy’s shipments comes from its mines in the Powder River Basin in the Western region. According to the EIA, coal production rose nearly 17.0% in the Western region, 8.0% in the Appalachian region, and 4.0% in the Interior region since the start of 2017.

According to World Steel Association, Asian crude steel production in August 2017 was 101.2 million tons higher than 94.4 million tons in August 2016. That could positively impact Peabody Energy’s Australian metallurgical coal shipments in 3Q17.

Next, we’ll see if analysts expect Peabody Energy’s margins to improve.