Why the Euro Could Remain Volatile This Week

The euro (FXE) closed the week ended September 1, 2017, at 1.19 against the US dollar (UUP). It lost 0.56% against the US dollar.

Sept. 5 2017, Updated 3:06 p.m. ET

Euro rallied to a 2-year high and then dwindled

The euro (FXE) closed the week ended September 1, 2017, at 1.19 against the US dollar (UUP). It lost 0.56% against the US dollar as dollar bulls dominated the foreign exchange markets after the August jobs report on Friday. Before the fall, the euro rallied to 1.21, but news reports suggesting that the ECB (European Central Bank) will not announce any tapering in its September 7, 2017, meeting added to the downward pressure on the euro.

European equity markets (VGK) were mixed in the previous week ended September 1, 2017. The German Stock Index (or DAX) ended the week falling 0.21%. The Euro Stoxx Index (FEZ) rose 0.16%, and France’s CAC Index rose 0.37%.

Euro bulls decrease their bets

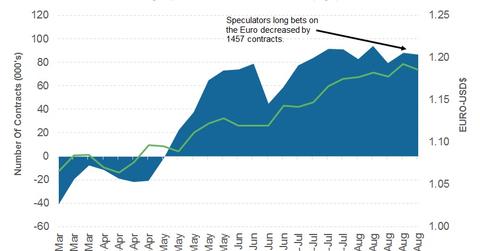

According to the latest Commitment of Traders Report released on Friday, September 1, 2017, by the CFTC (Chicago Futures Trading Commission), speculators turned bearish on the euro.

The total net speculative bullish positions on the euro (EUFX) decreased from 87,976 contracts through August 22, 2017, to 86,519 as of August 29, 2017. Euro bulls are likely to take a breather before the key ECB meeting. The European currency continues to remain a buy on every dip for the time being.

Euro is likely to remain volatile this week

Uncertainty about the ECB policy stance and the ongoing geopolitical tensions surrounding North Korea are likely to keep currency traders on edge.

Economic data scheduled to be reported this week include the euro area Sentix Investor Confidence on Monday, the euro area retail sales data on Tuesday, German factory orders on Wednesday, and the important ECB meeting on Thursday. It’s unlikely that the ECB would announce any tapering plans at the September meeting since ECB president Mario Draghi has clearly mentioned that tapering discussions would only begin in the fall.

Euro bulls will probably pay attention to what Draghi says about the euro’s strength. He has used such a stage to talk down the euro on previous occasions.