Understanding the Oil Futures’ Forward Curve

On September 26, 2017, US crude oil November 2017 futures traded just $0.14 below the November 2018 futures.

Sept. 28 2017, Updated 9:11 a.m. ET

The oil futures spread

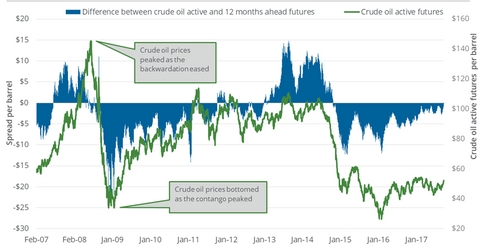

On September 26, 2017, US crude oil (USO) (DBO) November 2017 futures traded just $0.14 below the November 2018 futures. In fact, on September 25, US crude oil November 2017 futures were $0.02 above the November 2018 futures.

The difference between the two futures contracts is referred to as the futures spread. On September 19, 2017, US crude oil (USO) (DBO) November 2017 futures settled $1.4 below the November 2018 futures, and so the futures spread was at a premium of $1.4. Between September 19 and September 26, US crude oil futures rose 4%.

Oil prices during contango

The oil futures forward curve is said to be in contango when the futures spread is at a premium, and any rise in this premium can pull oil prices to a downside. On February 11, 2016, the premium rose to $12.01. On the same day, US crude oil prices plunged to a 12-year low.

Oil prices during backwardation

The oil futures’ forward curve is said to be in backwardation when the futures spread is at a discount. Any rise in this discount can push oil prices to an upside.

On June 20, 2014, this discount rose to $10.53. On the same day, oil prices were at a peak before a three-year downturn in oil prices.

In the trailing week, the oil futures spread shifted from contango to slight backwardation and then back to slight contango. Oil prices also rose 4% during this time period, which could signal that the oil supply-demand balance is turning bullish. It could also mean that the oil bulls are taking charge of the futures market.

Energy stocks

A possible shift in US crude oil’s futures forward curve could impact the hedging decisions of US oil producers (XOP) (DRIP) (IEO). During backwardation, oil producers find selling current production at current prices more profitable, compared with storing it and selling it at a later date for lower prices. This also influences midstream (AMLP) oil transportation and storage businesses.

On September 26, 2017, US crude oil futures contracts for delivery until March 2018 settled at progressively higher prices. Given the upward-sloping futures forward curve, ETFs that are meant to track US crude oil futures, such as the United States Oil Fund LP ETF (USO), could underperform active crude oil futures.