The Latest on TEVA’s Oncology Business

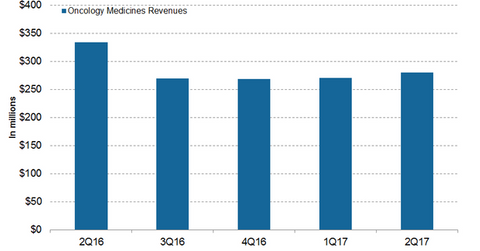

In 1H17, Teva Pharmaceutical’s (TEVA) oncology business generated revenues of ~$550 million, or ~9% lower YoY (year-over-year).

Nov. 20 2020, Updated 11:24 a.m. ET

Oncology revenue trends

In 1H17, Teva Pharmaceutical Industries’ (TEVA) oncology business generated revenues of ~$550 million, or ~9% lower YoY (year-over-year). In 2Q17, the oncology business generated revenues of ~$280 million, or ~16% lower YoY and 4% higher QoQ (quarter-over-quarter).

Teva’s oncology products in US markets include Treanda-Bendeka, Granix, and Trisenox. Outside the US, Teva commercializes Lonquex, Tevagrastim, Trisenox, and Treanda.

Treanda-Bendeka revenues

In 1H17, Teva’s Treanda-Bendeka generated revenues of ~$320 million, or 12% lower YoY. In 2Q17, Treanda-Bendeka reported revenues of ~$163 million, or 21% lower YoY and 4% higher QoQ.

Treanda-Bendeka (bendamustine hydrochloride) injection is used for the treatment of individuals with chronic lymphoblastic leukemia and individuals with indolent B-cell non-Hodgkin’s Lymphoma that has advanced through or within six months of treatment with rituximab.

Recent developments

In June 2017, the FDA (US Food and Drug Administration) accepted for review Teva’s and Celltrion’s BLA (biologics license application) CT-P10, a proposed biosimilar of Roche’s (RHHBY) Rituxan. Rituxan is a blockbuster drug used for the treatment of individuals with chronic lymphocytic leukemia (CLL), rheumatoid arthritis (RA), non-Hodgkin’s lymphoma (NHL), granulomatosis with polyangiitis, and microscopic polyangiitis.

In July 2017, the FDA accepted for review Teva’s and Celltrion’s BLA for CT-96 a proposed biosimilar of Roche’s Herceptin. Herceptin is another blockbuster drug used for the treatment of Human Epidermal growth factor receptor-2 overexpressing breast cancer. Herceptin is also used for the treatment of individuals with HER2-overexpressing metastatic gastric or gastroesophageal junction adenocarcinoma.

Teva’s peers include Amgen (AMGN), AbbVie (ABBV), Novartis, Pfizer, Roche Holding, and Takeda Pharmaceuticals. Notably, the Generic Drugs ETF (GNRX) invests ~4.4% of its total portfolio in TEVA.