Reading the Correlation Analysis of Mining Shares in August 2017

Yamana Gold has the highest correlation with gold, while Pan American Silver has the lowest correlation.

Sept. 6 2017, Published 1:19 p.m. ET

Mining shares

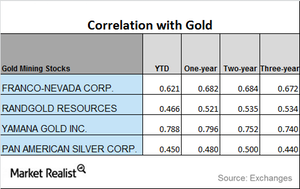

It’s crucial for investors to know how mining stocks’ daily changes relate to precious metals. In this part of the series, we’ll analyze the correlations of Franco-Nevada (FNV), Randgold Resources (GOLD), Yamana Gold (AUY), and Pan American Silver (PAAS) with gold.

The Global X Silver Miners ETF (SIL) and the iShares MSCI Global Gold Miners (RING) are also closely correlated with gold. SIL and RING have risen 3.9% and 6.2%, respectively, on a five-day trailing basis.

Correlation trends

Of the above miners, Yamana Gold has the highest correlation with gold, while Pan American Silver has the lowest correlation. Yamana Gold has seen an upward trend in its correlations, while the other three miners have seen a mixed trend (mix of uptrend and downtrend) in their correlations with gold.

An increase in correlation indicates that price fluctuations in gold could prompt mining shares to move in the same direction. A fall in correlation suggests that the returns of a mining share may diverge from what’s happening with the price of the metal.

Yamana’s correlation has increased from a three-year correlation of ~0.74 and a one-year correlation of ~0.80 with gold. A correlation of ~0.80 means that the price has moved alongside gold about 80.0% of the time since the start of 2017. But correlations can move in different directions at different times.