More Temporary Relief from North Korea Tensions?

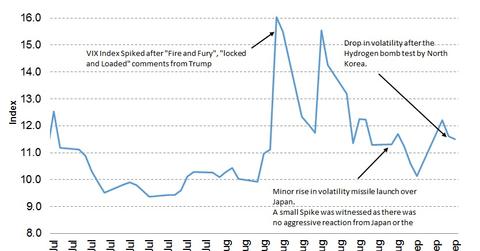

This week volatility (VXX) has continued to stick to its trend of sudden spikes and then dropping immediately.

Sept. 8 2017, Updated 12:06 p.m. ET

North Korea tensions recede

In our September risks to markets series, we mentioned North Korea tensions as one of the key factors that could impact markets this month. Though the uncertainty about future actions continues, there have been assuring statements from key stakeholders this week. On Thursday, China agreed that further action against North Korea is necessary from the United Nations. Plus, the heads of Japan, South Korea, and the US made comments that tipped the conflict towards a non-military solution, which helped to calm investor anxiety.

Volatility drifted lower as risk aversion fell

This week volatility (VXX) has continued to stick to its trend of sudden spikes and then dropping immediately. Uncertainty about the US debt (GOVT) limit crisis was completely wiped out and military action on North Korea remains unlikely at this juncture. Investors took to riskier assets as the week progressed, and volatility (VIXY) dropped from its recent peak. Going forward, anxiety about the North Korea tensions will be in the back of investors’ minds, but in the absence of any further aggression, risk aversion levels could be limited.

Could there be a further escalation of tensions?

There is always a possibility of escalated tensions, as we cannot estimate what steps North Korea will take. Even if North Korea conducts further tests, the impact on markets could be like what we have been seeing in the last few weeks. Volatility is likely to spring up and demand for safe havens like gold (GLD) and the Japanese yen (FXY) could increase and then fall back to normalcy.

Though two major risks for financial markets in September have subsided and the European Central Bank has made clear its intentions to tighten policy, the risk from a Fed surprise remains. Markets are not pricing in any action from the Fed this month. If the Fed sounds even slightly hawkish, there could be another bout of volatility during the month.